Managing and assuring private 5G networks: the next big opportunity

Ken Gold, director of test, monitoring and analytics solutions at EXFO, discusses why 5G standalone networks provide a huge opportunity for enterprise and MNOs.

Get up to speed with 5G, and discover the latest deals, news, and insight!

You are now subscribed

Your newsletter sign-up was successful

Plenty of fanfare (let’s be honest and say “hype”) has permeated the arrival of 5G standalone (SA) networks. This makes sense. After all, 5G SA promises significant advances, like enhanced mobile broadband (eMBB), ultra-reliable low-latency (URLCC), and massive machine-type communication (mMTC).

Few people can predict where the benefits will accrue, but there’s a real buzz around private networks for enterprise customers, and much of it is coming from mobile network operators (MNOs).

What is a private 5G network?

"Private networks make sense when enterprises believe a public network cannot deliver the service levels required."

Ken Gold, EXFO.

A private network is a network built for the exclusive use of a single enterprise customer. Such networks can be based on various technologies. And private networks make sense when enterprises believe a public network cannot deliver the service levels required to meet their business needs.

Those needs may include:

- optimized radio coverage (e.g., indoor, in hostile environments like manufacturing areas with high levels of interference);

- network performance (e.g., extremely low latency for AR/VR use cases, or uplink/downlink capacity and speed for data centers);

- and security (e.g., closed user groups, data privacy protection).

Why build a 5G SA network?

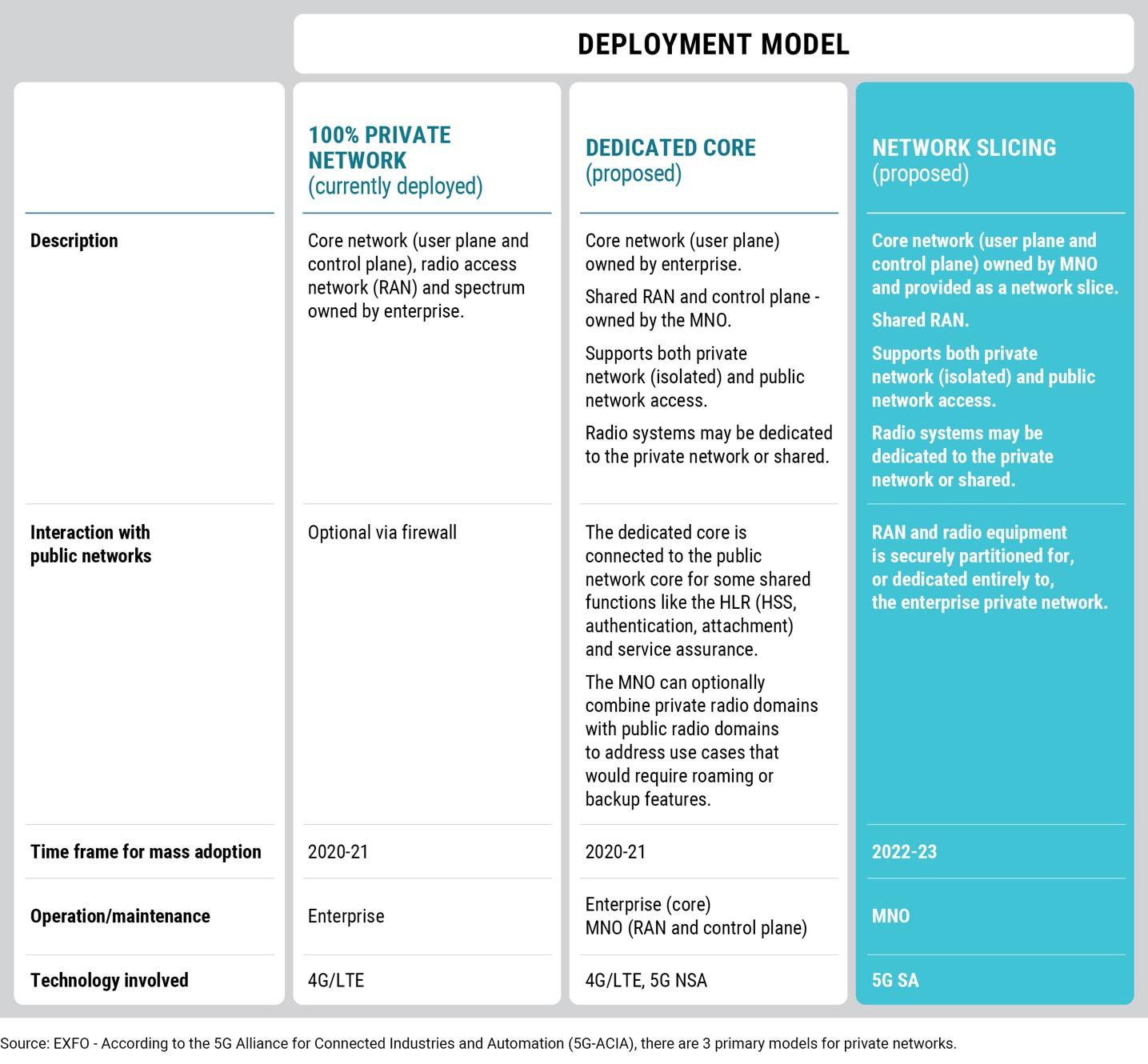

5G SA networks are more feasible than others to build since they are virtual, cloud-based, and orchestrated. But how they are built depends on the type of network companies and organisations are looking for. According to the 5G Alliance for Connected Industries and Automation (5G-ACIA), there are three primary models for private networks – 100% private, dedicated core, and network slicing – which you can see in the table below.

Although “Static slice” network slicing can be delivered using 4G/LTE or 5G NSA, this isn’t good enough for today’s requirements. Network slicing can only reach its potential when the slices evolve from static to dynamic in nature. This can only happen when the following are available:

- 5G SA core

- E2E virtualization

- URLLC-enabled architecture

This won’t happen overnight. Complete standardization of dynamic network slices is planned for 3GPP releases 16 and 17. Mobile operators then believe it may take an additional two years to fully implement.

Get up to speed with 5G, and discover the latest deals, news, and insight!

The market opportunity

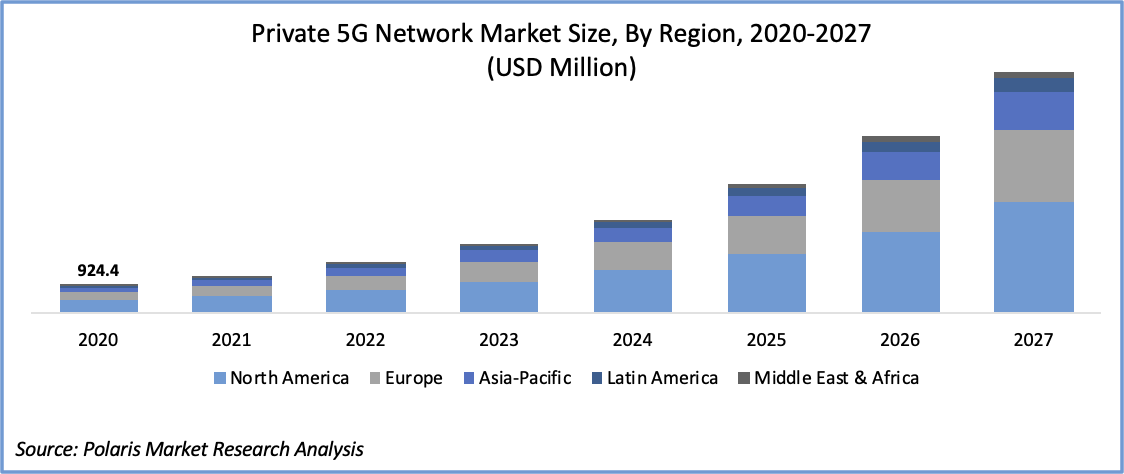

The private network market is set to experience significant growth, not only because of the availability of 5G technology, but also because of the impact of COVID-19.

A recent Mission Critical Magazine article (November 12, 2020) states, “In the wake of the COVID-19 pandemic, Wi-Fi hotspots are overloaded, so demand has increased significantly for higher capacity and increased data speeds. Therefore, incorporating private 5G networks has increased among organizations, regulators, manufacturers, and others.”

(Below: A November 2020 study by Polaris Market Research concurs. It states that the global market for private networks is expected to reach $8.32B (USD) by 2027—a CAGR of 38.6%.)

MNOs are taking notice

MNOs will want a share of this promising market, especially as it would be a net revenue increase on top of their legacy mobile services. (According to recent GSMA research, 82% of mobile operators view the enterprise market as key to their 5G strategy, with 70% planning to deploy standalone 5G within three years, largely targeting the enterprise segment.)

"Few count keeping up with quickly evolving technology like 5G SA as part of their core businesses."

Ken Gold, EXFO.

And while large enterprises may deploy and operate private mobile networks on their own, few count keeping up with quickly evolving technology like 5G SA as part of their core businesses. MNOs, on the other hand, do nothing else. They bring significant credibility and experience to bear. They’re better equipped to support and deliver mission-critical applications over 5G SA. Consider their expertise and resources:

- MNOs already design, deploy and operate complex mobile networks.

- MNOs can provide backup network support using their public, cloud-based 5G SA infrastructure to maintain critical services at high performance levels.

- MNOs can deliver, if necessary, continuity of service outside the enterprise or campus area through the public 5G SA network.

- MNOs can deploy shared edge cloud facilities to serve multiple enterprises located in the same industrial area or business center, which would significantly reduce the cost of private network infrastructure.

- MNOs have OSS/BSS solutions that they already use to manage private networks.

- The OSS/BSS solutions noted above enable automated updates to private network infrastructure (with no impact on the customer’s service performance) since the solutions include emerging continuous integration, continuous development (CICD) processes.

MNOs may run into competition from network equipment manufacturers (NEMS) or system integrators. Successful MNOs will differentiate themselves using high-value services the competitors can’t, offering stringent SLA contracts, whilst assuring their service with 24×7 monitoring and maintenance, whilst meeting mean-time-to-repair (MTTR) contractual obligations to support enterprise business continuity.

The next step towards 5G SA: assuring private networks

Service assurance must play a significant role in private networks. After all, enterprises use these networks to secure critical functionality, like latency, throughput or security. This means the service provider must have complete visibility into how services perform in the private network. If that visibility is lacking, significant SLA penalties may lie in wait.

"Ideally, in private networks, service assurance becomes part of the service definition for every service in the network."

Ken Gold, EXFO.

Ideally, in private networks, service assurance becomes part of the service definition for every service in the network. Fortunately, the very nature of a 5G SA network, with its cloud-based micro-services, orchestration and scalability, lends itself to cost-effective service assurance solutions. When done right, using machine learning-based anomaly detection on live streaming assurance metrics and AI-based anomaly correlation and analysis, service assurance can be automated to deliver near real-time root cause determination.

Root causes can then be fed back to the service and domain orchestrators for corrective action—possibly even before the customer notices any issues.

Keeping data storage reasonable

Storing, moving and analyzing “big data” can quickly become expensive and erode the cost-savings argument for a cloud-based solution. Fortunately, you don’t need to store massive amounts of performance data. Instead, service assurance solutions can analyze the live stream or performance data and extract only what’s interesting (typically less than 10% of the total). In other words, you only extract anomalies, and you end up with “small data” from big data. And this keeps cloud costs under control.

But that’s not the only way an orchestrated service assurance solution minimizes cloud and testing costs. The service provider can quickly scale up probing and analytics to investigate a detected anomaly. Then, once it’s resolved, the provider can scale back the assurance solution.

5G SA network service assurance

Service assurance for 5G SA networks, including private networks, will differ significantly from traditional assurance. 5G SA supports more services, and besides being virtual and highly dynamic, these networks will support a much more diverse set of services based on eMBB, URLLC, and mMTC.

Many of the services that run on 5G SA will demand better availability than the “3-9s” availability (8.77 hours of downtime/year) typically expected in traditional mobile networks. Services like remote healthcare or drone control will require at least “5-9s” availability (5.26 minutes of downtime/year), with other applications demanding “6-9s” (31.56 seconds of downtime/year).

5G SA networks must be highly dynamic, scalable and cost-effective, and a service assurance solution with the same qualities will keep them 100% reliable, and capable of living up to even the most demanding SLAs.

Ken Gold has a diverse background in the telecommunications industry spanning more than 30 years. He is currently focused on understanding how virtualization and 5G will change the way people and machines communicate and how the carrier will leverage automation, artificial intelligence and machine learning to manage quality of experience in this new reality—which in the end is all that matters. Prior to joining EXFO, Gold held leadership roles in Solutions Marketing and Product Line Management with Nortel, Harris Broadcast, ADTRAN and Accedian Networks, focused on optical transport and Carrier Ethernet service assurance and performance monitoring.