10 top 5G stocks for 2021: discover some of the hottest 5G companies

How are 5G stocks performing in the middle of September? This 5G stocks update includes gains for MediaTek.

Get up to speed with 5G, and discover the latest deals, news, and insight!

You are now subscribed

Your newsletter sign-up was successful

5G stocks, as with most investments, have been affected by a turbulent year in 2020, but in 2021 we are starting to see 5G stocks recovering from the effects of coronavirus, and from the uncertainty that surrounded the US presidential race.

The stock market saw big dips at the end of March 2020, and 5G stocks were amongst those affected. However, since then the market has started its recovery, and the picture for 5G stocks in 2021 still looks attractive to investors. And October through November has seen 5G stocks continuing to increase in value, which will be further buoyed by the recent launch of the 5G iPhone.

The Covid-19 outbreak, and the need for many people to work remotely, and access the internet on the move, has highlighted the importance of 5G technology. And rather than sideline plans for 5G investment, some reports show that the pandemic has moved 5G up the priority list of many enterprises, and consumer use is also increasing.

5G stocks have fluctuated over the last 12 months. Mobile network operators around the world chose 2020 to roll out their first 5G services, billions of dollars were spent on upgrading technology and marketing these new services, and Apple – although a little late to the party – chose 2020 to release its 5G iPhone.

But with so much disruption within the networking and telecommunications industries, what can we expect to see in 2021?

5G stocks prices are on the up

The launch of 5G will affect a huge number of companies, from mobile networks, to healthcare and gaming. This will consequently boost the stock market, as 5G brings new opportunities and revenue streams for companies. And 5G stock prices are likely to increase, as they have over the last 12 months.

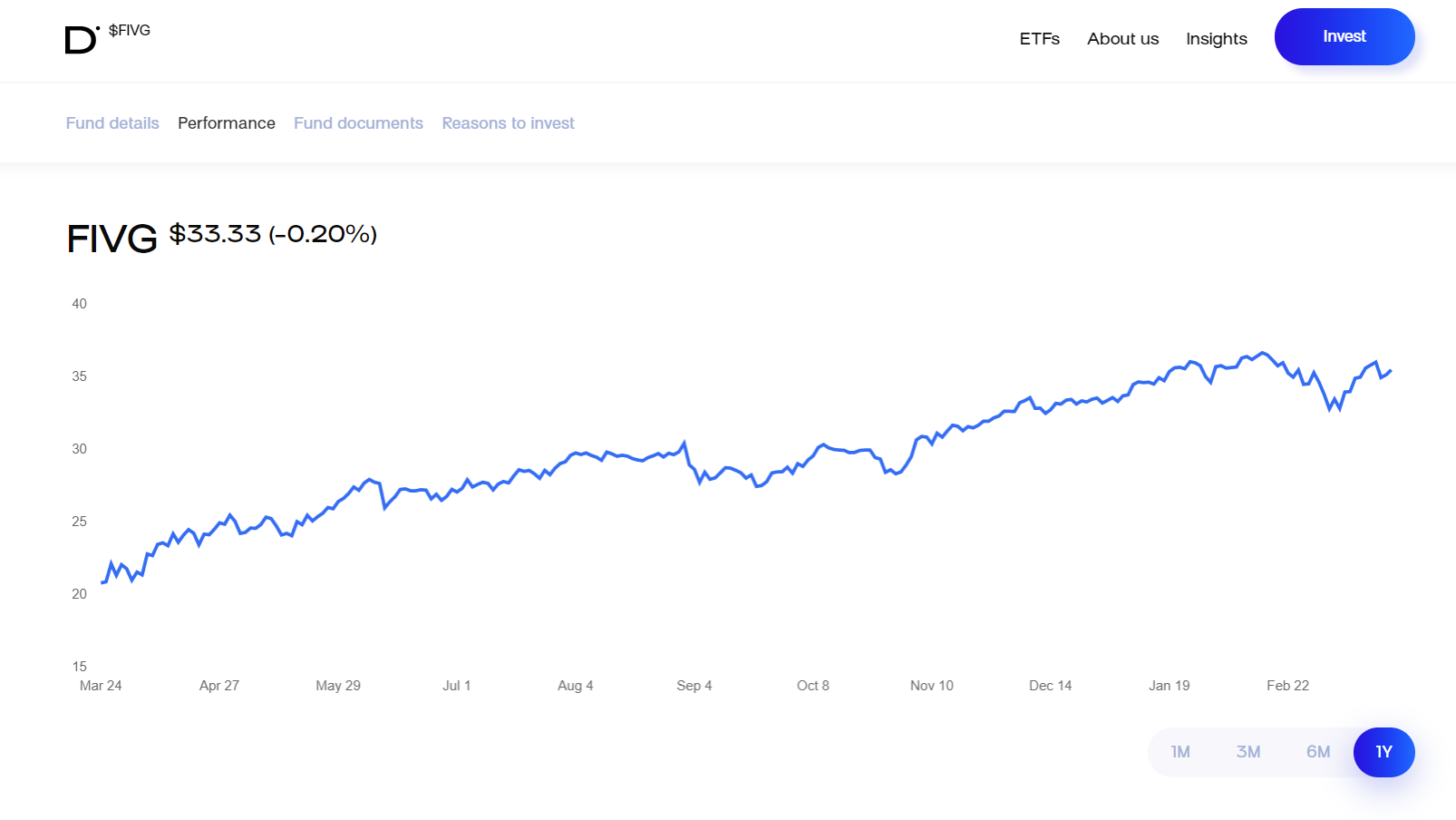

In fact, there are entire funds dedicated to 5G tech, such as the The BlueStar 5G Communications Index, which, even with 77 listed companies can sometimes miss 5G stocks that might not fall within its relatively strict remit (such companies focussing on services delivered via 5G). (Defiance ETFs is an exchange-traded funds sponsor and registered investment advisor focused on the next generation of sector investing.)

In this update we bring you updates on the hottest 5G stocks.

Disclaimer: The information below is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Hot 5G stocks: T-Mobile

Exchange: NASDAQ

Current price: $127.57

Market cap: $158.58bn

Year high: $150.20

Year low: $108.86

P/E ratio: -

Dividend yield: -

T-Mobile US (NASDAQ:TMUS) completed its merger with Sprint in April 2020, creating what the company heralded as a "supercharged Un-carrier that will deliver a transformative 5G network". And marketing speak aside, this wasn’t far off the mark.

At the merger announcement the company said that it expects 14 times more total capacity over the next six years than T-Mobile has today, with T-Mobile also announcing that all new subscribers to T-Mobile would get free access to 5G.

T-Mobile has performed consistently well over the last five years, which has seen the stock price grow from $40 to $115 over that period. And even after the T-Mobile merger with Sprint had been completed, T-Mobile had a debt of $72.5 billion, which, although significant, is far less than the $169 billion and $113 billion that AT&T and Verizon owe, respectively.

Week-on-week we saw T-Mobile recover from a market-wide dip that affected most 5G stocks in the heat of the US election, and T-Mobile shares recovered by 12 cents, bringing it close to its 12-month high.

Most recently, T-Mobile addressed what it called the “carrier death grip” of its competition, announcing three new products – 'Home Office', 'Collaborate', and 'Enterprise Unlimited' plans – which will fall within a new offering called ‘WFX’ (work from anywhere). And in April the company announced 74 cents in earnings per share in the first quarter, which was above Wall Street’s average estimate of 54 cents. Revenue was $19.8 billion, almost a billion dollar above expectations, and the company also added a net 1.2 million increase in bill-paying subscribers, which was also higher than expected.

This resulted in a boost to the company's stock of around three percent, with the share price rising to $136.00 by September 6th. But a move by KeyBanc Capital Markets to downgrade T-Mobile may have had a negative effect, as the share price dipped to $127 as of September 16th.

Hot 5G stocks: Skyworks Solutions

Exchange: NASDAQ

Current price: $176.97

Market cap: $29.19bn

Year high: $203.80

Year low: $132.60

P/E ratio: -

Dividend yield: -

Skyworks Solutions (NASDAQ: SWKS), the semiconductor company, generated 51% of its total revenue from Apple last year. This is both good and bad news as the 5G iPhone release was hit with delays in the wake of coronavirus, which resulted in a 5% dip, followed by an almost immediate recovery. And whilst November 2020 saw a certain amount of volatility in price, Skyworks' share price rose to $151.84 by the 15th January 2021, and jumped a further 20% in the following weeks, hitting a 52-week high of $204 by the end of April.

However, citing the "limited upside potential," Goldman Sachs has recently downgraded Skyworks Solutions from 'Buy' to 'Neutral'. And this announcement, as well as the recent news that its stock had underperformed when compared to some major competitors, saw the 52-week high quickly followed by a dip that took the share price down to $171.31 as of June 21st. However, it has recovered significantly over the last few months, recovering to $183.01 by September 6th, before dipping again to $176.97 by September 16th.

"While we remain constructive on Skyworks' long-term competitive position in the growing RF market, we expect the stock to perform largely in line with our broader Semiconductor and Semiconductor Capital Equipment coverage universe through the balance of the year, with our CY21/22 estimates only marginally above Street consensus and the stock trading at a NTM P/E multiple relative to the S&P 500 that is largely in line with its past 3-year median," explained Goldman Sachs analyst, Toshiya Hari.

Gartner had originally estimated that 221 million 5G smartphones could be sold in 2020 and the Covid-19 outbreak has had an obvious knock-on effect.

However, with Skyworks being one of the main chipmakers for huge players such as Apple, and with the US trade ban on Chinese technology spreading around the globe, it isn’t an investment to be overlooked. And despite Skyworks being on the radar of many investors over the last few months, it still looks like a good choice for those looking for 5G stocks.

Hot 5G stocks: Ericsson

Exchange: STO: ERIC-B

Current price: SEK 100.06

Market cap: SEK 307.42bn

Year high: SEK 121.80

Year low: SEK 93.42

P/E ratio: 17.26

Dividend yield: 1.96%

Ericsson (STO: ERIC-B) stock jumped around 10% as Ericsson announced adjusted sales for the last financial year of SEK69.6bn (£6bn), an increase of 13% year on year, which the company says was driven by 5G and by sales in Northeast Asia, Europe and North America. Operating income, which excluded restructuring costs, also increased by 80% to SEK11bn, while reported net income was SEK7.2bn.

Strategic contracts, especially those in China, were flagged up by Ericsson as a cause for confidence, and it will no doubt be looking to expand on key partnerships, such as winning an 11.5% stake in a $52bn China Mobile tender (the only European company to do so).

Elsewhere, strong investments in R&D have resulted in the company’s patent licensing business continuing to perform well, due to its impressive IPR portfolio, much of which has taken place in the 5G market with “proven performance and cost of ownership benefits".

“We have continued to increase our market share in several markets by leveraging our competitive product portfolio,” Ericsson's Q2 report says. “Profitability in earlier awarded strategic contracts has improved according to plan. We consider strategic contracts to be a natural part of the business and we will stop our forward looking commentary unless there is an extraordinary impact.”

To top off a good period for the company, it also announced recently that it would be working in Oman to help deliver 5G, as part of a multi-year partnership. And this resulted in the company's share price rising from 87.64 SEK to 96.86 SEK in just 24 hours. And since mid-October, we've seen a slow but steady climb in price, and following better-than-expected financial results, it currently sits at SEK 100.06.

So not the strongest of 5G stocks, but well worth considering if you're looking at a longer-term investment.

Hot 5G stocks: Nokia

Exchange: OMXH

Current price: €4.82

Market cap: €27.35bn

Year high: €5.38

Year low: €2.70

P/E ratio: n/a

Dividend yield: n/a

In October 2019 Nokia (HEL: NOKIA) dropped its 2019/2020 outlook as profits came under pressure due to the company spending more on its 5G networks.

Whilst Nokia did meet third-quarter expectations, it still decided to cut profit predictions. On top of this, the company paused dividend payments in order to raise investments for 5G. The extra investments that 5G demands put pressure on the company's finances, and as a result Nokia shares plummeted by 21%.

However, there are green shoots of a recovery coming through, and Nokia has been vocal about its support for open O-RAN technologies, which will be music to the ears of potential partners that may be looking to move away from Huawei.

This has resulted in Morgan Stanley analyst, Dominik Olszewski, upgrading Nokia's 5G stocks rating to Overweight from Equal Weight, with a new price target of €5.00, up from €3.65. Add to this the fact that Nokia's year-on-year sales rose 3% to €5.08 billion, and Nokia looks to be eyeing a brighter future, with its share price currently sitting at €4.82 as of September 16th.

Nokia has also announced its next-generation 5G AirScale Cloud RAN solution based on vRAN2.0, which will be commercially available in 2020. And earlier this year it announced a €400m 5G deal with Taiwan Mobile.

Hot 5G stocks: Ciena

Exchange: NYSE

Current price: $53.38

Market cap: $8.27bn

Year high: $61.09

Year low: $38.03

P/E ratio: 18.09

Dividend yield: -

Ciena Corporation (NYSE: CIEN) is a US-based fiber networking specialist, which also produces a number of software-based products that enable network operators to manage xHaul (existing backhaul and fronthaul networks) within 5G networks and beyond.

Ciena specializes in the installation and management of fiber optic networks, which are an essential part of the 5G networking infrastructure, and although other technologies can be used for IP transport, fiber is still the preferred choice.

During the company's fiscal 2020 second quarter, revenue increased by a conservative 3.4%, but adjusted earnings per share rocketed up by 58%, which is a reliable indicator that investors see a positive future for Ciena’s fiber solutions such as its Adaptive IP product. Although, due to the coronavirus pandemic, shares took a hit earlier this year, despite still being up year-on-year. For those that already own Ciena stock, now is not the time to sell. But it may be good point for investors to consider them, as historically Ciena posts annual growth.

In the week commencing 2nd November, Ciena's stock was valued at $39.15, but following the market rally after the US election, it returned to $42.87, and has continued to climb, to the point where it broke $50 by the end of December 2020. And although it still sits a little of its 2020 high of $60, Ciena has seen a decent recovery since the huge sell-offs across the stock market in September 2020, and, as of September 6th, it now sits at $56.92, bolstered by Bank of America changing its purchase status from 'neutral' to 'buy' at the end of January 2021.

As more networks make the move to 5G standalone, and upgrade networking infrastructure accordingly, Ciena will be well placed to handle installation, configuration, and management of fiber optic backhaul within 5G networks.

Hot 5G stocks: Qualcomm

Exchange: NASDAQ

Current price: $138.24

Market cap: $155.93bn

Year high: $167.94

Year low: $108.30

P/E ratio: 17.26

Dividend yield: 1.97%

Qualcomm (NASDAQ:QCOM) is one of the most prominent 5G stocks, and following a market-wide slump in the wake of coronavirus, Qualcomm's share price has recovered incredibly well, and it recently hit its 2020-high of $158.09 during December. Since then, it dipped slightly, dropping to $151.79 at the start of January, and after a short recovery, it dipped further to $127.87 by March 11th, recovering slightly over the next four months, to the point where it now sits at $138.24.

Having gained 83% in 52 weeks, Qualcomm should have had a good February, but its stock dropped, with a further decline at the start of March. For those questioning why this happened, it looks like Qualcomm's strong 2020 may not have been strong enough for some investors. So rather than Qualcomm being a busted flush, it might actually be a good time to buy.

And given its history, Qualcomm should bounce back. According to Yahoo! Finance: "One of the stand out quality metrics for Qualcomm Inc is its 5-year Return on Capital Employed, which is a solid 13.0%. Good, double-digit ROCEs are a pointer to companies that can grow very profitably."

And Qualcomm has also seen its stock on the rise following the recent announcement that Qualcomm was launching its new Robotics RB5 platform, which integrates key capabilities such as high-performance heterogeneous computing, 5G/LTE, hi-fidelity sensor processing for perception, odometry for localization, mapping, navigation, strong security, and Wi-Fi connectivity.

The news instigated a six dollar jump in Qualcomm's share price, as the momentum around 5G use cases within the industrial sectors. (The Qualcomm Robotics RB5 platform is designed for the next generation of high compute, low-power robots and drones for the consumer, enterprise, defense, industrial and professional service sectors.)

Hot 5G stocks: Aviat

Exchange: NASDAQ

Current price: $34.87

Market cap: $489.33m

Year high: $43.76

Year low: $9.25

P/E ratio: 3.70

Dividend yield: -

Aviat Networks (NASDAQ: AVNW) recently announced that it is working with Safaricom, the largest telecom company in Kenya, to deliver a backhaul connection in remote areas using microwave technology.

Given what we've already reported, regarding the slump during the conclusion of the US election, it should come as no surprise that Aviat Networks had recovered from $18.75 to $34.87 by September 16th 2021.

Rolling out 5G in more remote locations poses a number of challenges for mobile network operators (MNOs) around the world, one of the biggest being establishing a backhaul connection when there isn’t the option to run fiber or copper cable to a cell site.

In these cases, MNOs are turning to microwave frequency bands, which, although having extremely poor general coverage, are perfect for focusing a narrower beam, which creates a point-to-point connection between sites, and can deliver speeds of up to 10Gbps, over a distance of six miles.

And Aviat says that its multi-band products, such as the The WTM 4800, provide the lowest TCO for 5G backhaul, especially in countries, like Kenya, where the cost of microwave spectrum is high.

Hot 5G stocks: Marvell Technology

Exchange: NASDAQ

Current price: $62.46

Market cap: $51.44bn

Year high: $64.07

Year low: $35.30

P/E ratio: -

Dividend yield: 0.38%

Marvell Technology Group (NASDAQ: MRVL) received a downgrade at the start of the year, but this didn't cause panic amongst investors, who saw the stock rally, from $21 at the end of February, to over $45 at the beginning of December. And it jumped further at the start of January, settling to $50.98 by February 22nd, and over the summer it has climbed steadily to $62.46 as of September 16th.

Similar to Qualcomm, the reason for this is likely to be lower-than-expected results, despite Marvell stock increasing by 80% in the past year the PHLX Semiconductor index only increasing by 58% in comparison).

Marvell, which made nearly $3 billion in revenue during 2019, has entered partnerships with companies such as Nokia, which it will supply with a new range of system-on-a-chip and infrastructure processors. Marvell's chipsets will eventually replace the field programmable gate arrays (FPGAs) that Nokia originally chose for its 5G products. These were an expensive option that doesn’t appear to have paid off.

The fact that Marvell stock has grown so significantly in recent years may have moved it beyond the interest of many investors, with some claiming that it may be over-valued, but it could still make a good buy for those looking for a longer-term investment.

Hot 5G stocks: American Tower Corporation

Exchange: NYSE

Current price: $297.17

Market cap: $137.46bn

Year high: $302.94

Year low: $198.90

P/E ratio: 59.88

Dividend yield: 1.71%

American Tower Corporation (NYSE: AMT) is an owner and operator of wireless infrastructure. This company has an impressive $100.36bn market cap and a huge global footprint. AMT owns over 170,000 telecom infrastructure sites, and so is perfectly placed to benefit from 5G.

At the beginning of 2020 AMT stock rose by nearly 2% after it was upgraded to ‘Buy’ by Goldman Sachs, as they see rapid growth from expanding 5G coverage.

However, the stock has seen more conservative increases as the company was hit by the effects of the coronavirus pandemic, and the slowing roll out of 5G around the world.

But, like other communications infrastructure companies, the next few months should see a return to previous levels of growth, and its stock currently sits at $297.17, just a few cents of its 12-month high. And this increase has also been buoyed by above-average performance against analyst reports.

Add to this the increasingly defensive position of the US government when it comes to technology providers, and the future looks bright for the American Tower Corporation, as demand for 5G infrastructure continues to grow.

Hot 5G stocks: MediaTek

Exchange: TPE

Current price: 936.00 TWD

Market cap: 1.49tn TWD

Year high: 1,185.00 TWD

Year low: 581.00 TWD

P/E ratio: 18.33

Dividend yield: 3.95%

In August 2020, US sanctions on Huawei were extended to MediaTek Inc. (2454:Taiwan), as the US DOC announced that it has added 38 Huawei affiliates to the US government's economic blacklist, taking the total to 152.

This caused a 10% drop in MediaTek’s share price, but this knee-jerk drop, alarming as it was for investors, doesn’t really paint a true picture of MediaTek’s investment potential. In fact, it may have made it even more appealing for investors willing to look at the longer-term.

Like other shares, it took a hit in the US election campaign, dropping to 665.00 TWD, but recovered to 686.00 TWD within a week, reflecting the resilience of this stock. And it has rallied every since, and by February 22nd it reached 951.00 TWD (having reached 1,010.00 TWD a few days prior to that, before dipping slightly). And the stock took a further dip, dropping to 870.00 TWD by March 23rd, before recovering to 936 TWD as of September 16th.

MediaTek recently announced its 7nm Dimensity 800U chipset, which has an impressive list of features, supporting sub-6Ghz SA and NSA networks, whilst also supporting technologies such as 5G+5G dual SIM dual standby (DSDS), dual Voice over New Radio (VoNR), and 5G two carrier aggregation (2CC 5G-CA).

And in recent news realme announced that it would be continuing to expand its range of affordable 5G phones, with the new realme 8 5G becoming the UK’s first smartphone to feature MediaTek’s Dimensity 700 5G processor.

- The best 5G networks in the UK and US

- Why 5G small cells are vital for mmWave 5G

- Millimeter wave: the secret sauce behind 5G

- Get updates on the hottest 5G stocks

- We reveal the latest 5G use cases

- Discover the truth behind 5G dangers

- 5G towers: everything you need to know

Get up to speed with 5G, and discover the latest deals, news, and insight!

Dan is a British journalist with 20 years of experience in the design and tech sectors, producing content for the likes of Microsoft, Adobe, Dell and The Sunday Times. In 2012 he helped launch the world's number one design blog, Creative Bloq. Dan is now editor-in-chief at 5Gradar, where he oversees news, insight and reviews, providing an invaluable resource for anyone looking to stay up-to-date with the key issues facing 5G.