5G mmWave spectrum explained

mmWave will power 5G apps relying on the speed and capacity of ultra-high millimeter wave frequencies.

Millimeter wave 5G – or mmWave, as it is also being referred to – is behind the next-generation of mobile applications. Here we'll explain what it is as well as how it'll impact 5G networks in areas where high-capacity, low-latency networks are required.

Next-generation 5G networks will not only provide ubiquitous, reliable coverage over wide areas, but will also be capable of powering mission-critical applications, massive IoT deployments, and entirely new business operations, all requiring fast, high capacity, ultra-low latency connections.

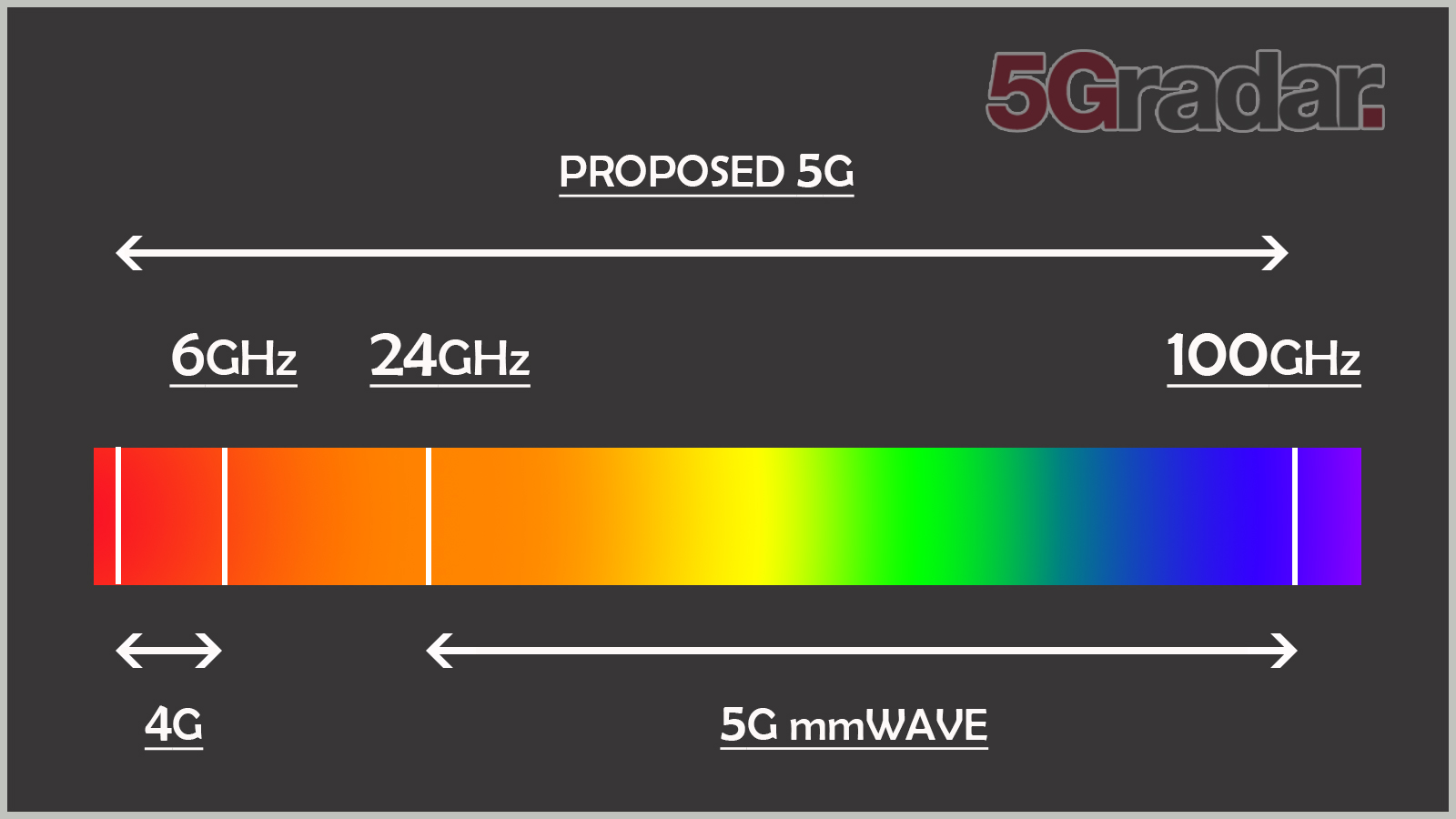

To achieve this, mobile operators will need to use a wider range of spectrum than they have done with previous generations of mobile technology. And like 4G networks, which are a mixture of low-range and mid-range frequencies, the same is true of 5G networks.

Crucially, spectrum is a finite resource. And as governments and regulators around the world recognise the potential economic and societal benefits of 5G networks, there have been concerted efforts to free up as much spectrum as possible.

Therefore, attention is being paid to bands previously considered to be unsuitable for mobile networks - and yes, that includes high-range millimeter wave (mmWave).

Many of these bands were allocated to other groups of users, such as the military or public events industry, long before the importance of mobile communications was realised, and so millimeter wave spectrum carries a high premium.

What is mmWave spectrum?

While low-level 700MHz might be useful in spreading 5G to rural locations, it's not suitable for providing the reliable connectivity required in a busy urban location.

Get up to speed with 5G, and discover the latest deals, news, and insight!

High range bands provide huge amounts of capacity across a limited geographical area. So where mmWave is key for 5G rollout is in dense city zones where there's need for high capacity - in other words, there are a lot of devices.

However, mmWave is not without its challenges. The signals don't go that far for one thing. mmWave had previously been shunned for mobile, because of its short-range and narrow wavelengths that were susceptible to atmospheric conditions. An effect, known as rain fade, sees precipitation absorb the radio signal and causes disruption. And there have also been concerns about 5G dangers coming from new spectrum usage, but these have been widely debunked.

Technically, the term mmWave refers to frequencies located between 24GHz and 300GHz located between microwaves and infra-red. These airwaves are currently used for things like scientific research, weapons systems and even police speed guns.

It is considered that the portion between 26GHz and 100MHz offers the greatest opportunity for mobile networks.

However, it is the previously undesirable qualities of mmWave that make it so suitable for 5G.

That's because it depends on the use of microinfrastructure, such as small cells dotted around dense city locations. This, coupled with high range frequencies will be a key characteristic of 5G networks.

Therefore, mmWave is only be needed across a limited range and the narrow wavelengths minimises the risk of interference from other cells – enhancing the efficiency of the spectrum.

The value of mmWave

Delegates at the World Radiocommunication Conference 2019 (WRC-19), a quadrennial gathering of regulators and governments organised by the UN-affiliated International Telecommunications Union, identified several mmWave bands that could be used for 5G networks. These included 24.25-27.5 GHz, 37-43.5 GHz, 45.5-47 GHz, 47.2-48.2 and 66-71 GHz.

The formal identification of these bands paved the way for global harmonisation, testing and standardisation – reducing costs and accelerating time to market. These agreements also ensured that safeguards for users of spectrum in adjacent bands, such as meteorological services, were in place.

The high capacity and ultrafast speeds of mmWave spectrum will enable many 5G applications that are less suited to lower-range bands. While it is expected that the majority of commercial 5G networks will deliver at least 1Gbps, it is mmWave that produces the theoretical maximum of 10Gbps.

The GSMA predicts that $565 billion in global GDP and $152 billion in tax revenue will come from mmWave 5G services over the next 15 years. This amounts to quarter of the predicted economic value that will be generated by all 5G networks during that period.

mmWave 5G auctions

Each country has its own way of allocating spectrum to those companies looking to operate in these frequency bands. In the last round of millimeter wave auctions in the United States, which took place on March 5th, 5th March, 37GHz, 39GHz and 47GHz spectrum bands were up for grabs. The total sales reached $7.558 billion, nearly tripling the combined total raised by two prior mmWave auctions, which generated $2 billion for 24GHz spectrum and $700 million for 28GHz. Verizon and AT&T emerged with the lion's share, spending $3 billion in total, to secure thousands of new mmWave licenses.

And despite the coronavirus pandemic, countries are still moving ahead with their plans to allocate mmWave spectrum to the highest bidders. For example, the Finnish telecoms regulator Traficom has announced that it plans to press on with the auction of 5G spectrum in May.

The auction will include three licences in the 26GHz band, each offering access to an 800MHz block of spectrum covering all of mainland Finland, with a starting price of €7 million. Registrations must be submitted to the Finnish Transport and Communications Agency Traficom by 20 May 2020, with winners clear to commence network construction on July 1st.

Fixed wireless access

The earliest example of 5G millimeter wave in action is Fixed Wireless Access (FWA) broadband. 4G-powered FWA is already in existence, but it is often unable to match the speed, reliability, and experience of a fixed connection. Data caps are also a huge barrier, especially when you consider that home broadband users consume more data than mobile subscribers.

Ovum says the average UK household currently consumes 190GB a month – a figure that will increase to 516GB by 2023 thanks to the popularity of video streaming services, online gaming, and other applications. 5G, free of the restrictions of 4G, can help satisfy this demand.

Trials of commercial 5G FWA networks using mmWave spectrum have achieved between 1-3Gbps, while analysts believe that consistent speeds of between 80 and100Mbps are achievable in a real world setting. In the US, both AT&T and Verizon offer 5G FWA in major US cities, offering a realistic alternative to locations where there is only one fixed cable provider.

Meanwhile, Three in the UK now offers 5G FWA in central London, while the government is looking at 5G to deliver a minimum standard of broadband in parts of the country where the commercial rollout of fibre is not economically viable.

Transforming industry and society

The industrial 5G use cases for mmWave 5G are strong, with the technology able to provide reliable, high performance connectivity anywhere in the world. Smart port technology is one of the most developed industrial applications for 5G, promising to drive efficiency and reduce costs through the automation and remote operation of machinery. Logistics, mining and other industries will also be transformed through the digitisation of processes and the enhanced productivity of the workforce.

According to a report from the California-based company Grand View Research, The global market size for private 5G networks will reach $920 million in 2020, and is estimated to register a compound annual growth rate (CAGR) of 37.8% from 2020 to 2027.

While consumer-facing mobile network operators (MNOs) talk predominantly about the speed of downloads, for manufacturing, the focus turns to ultra-reliable low-latency, density and ubiquitous connectivity. And it’s these lesser-known features, beyond the breakneck 5G speed, that are encouraging industry to construct private 5G network infrastructure in industrial plants and warehouses.

The report from Grand View Research claims that by 2020, the hardware segment is estimated to account for a market share of more than 70.0%, and said that it is due to the “growing deployment of core network and backhaul and transport equipment across the globe”.

Beyond industry, society will also benefit from smart city applications, such as transportation, and the provision of healthcare and access to essential services will also be revolutionised. Virtual training will help staff improve, while it will also be possible for specialists to assist with diagnosis and treatment remotely. This means that location will no longer be an impediment to care.

The same of true is education. Remote learning will become a possibility thanks to interactive lessons that make use of teleconferencing, Virtual Reality (VR) and Augmented Reality (AR) technologies.

mmWave powering industry 4.0

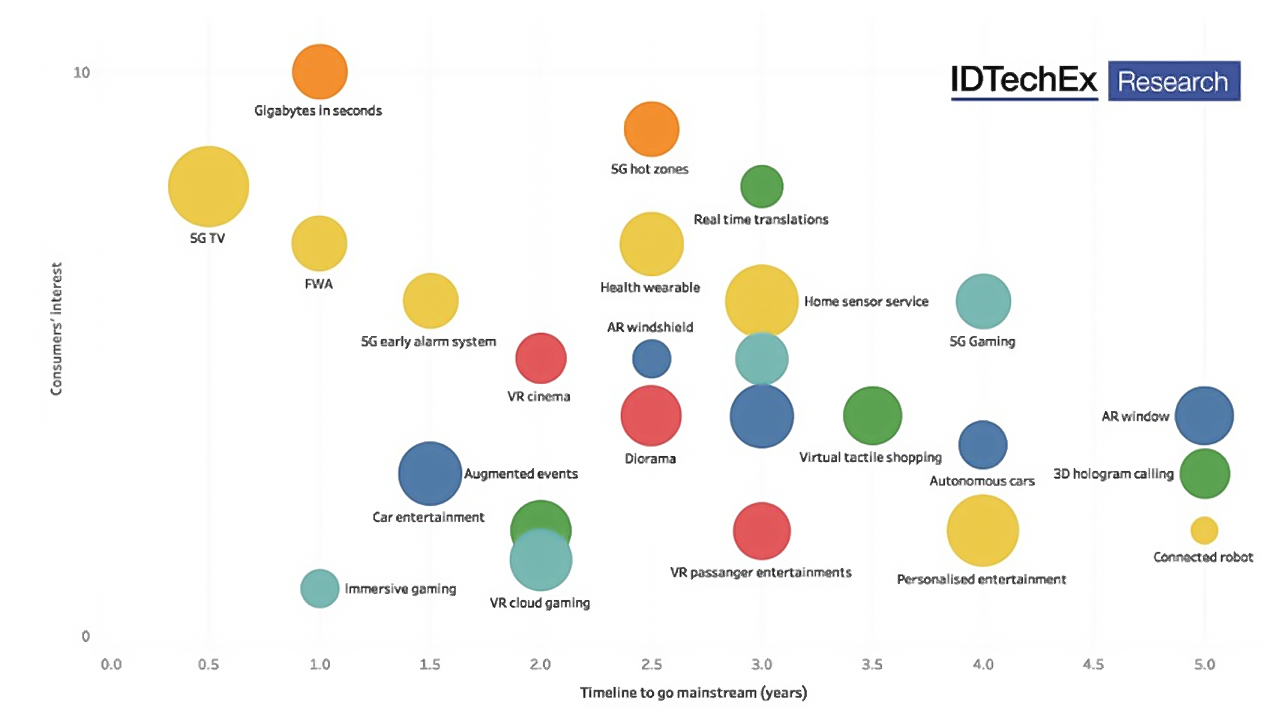

Elsewhere, another report, this time from IDTechEx, and titled ‘5G Technology, Market and Forecasts 2020-2030’, found that: “5G for smart manufacturing is considered as one of the key applications, assisted with AI and intelligent cameras, such as autonomous mobile robot and remote real-time manufacturing."

And the report highlights the opportunity for the medical sector, too, in areas such as telehealth, which are now more pressing than ever in s post-coronavirus world.

The report includes comprehensive company profiles for more than 20 key global players, from infrastructure suppliers to telecommunication operators, and provides a ten-year forecast for the 5G revenue. The report also highlights the availability and roll-out of mmWave 5G as the primary factor in the development of commercial 5G use cases, breaking down the requirements for 5G to succeed.

The report is currently available to purchase, but there are a number of insights, graphs, and timelines available for free, via the report homepage.

mmWave and wireless backhaul

It’s not just end user applications that will benefit from mmWave spectrum – mobile networks themselves will be made more efficient. Mobile operators plan to use mmWave spectrum for wireless backhaul – the link between mobile masts and the core network.

Traditional backhaul relies on a high quality fixed connection, something that might not be present in a rural area. Wireless backhaul provides greater flexibility and cost efficiency with regards to network construction in rural areas, while it will be essential for dense 5G networks populated by small cells and other microinfrastructure.

Verizon and Ericsson recently completed a proof-of-concept trial using new Integrated Access Backhaul (IAB) technology to deliver Verizon’s 5G Ultra Wideband service without the need for fiber installations, relying instead on a dedicated portion of available mmWave bandwidth to connect to the core network.

5G networks rely on fiber-optic cable to connect cell sites, and provide a fast, low latency connection back to the core network, but they are costly to install, and it can take time for mobile network operators to work through localized licensing and regulatory restrictions, which can cause significant delays to 5G network roll out.

Installing a fiber-optic network is a lengthy and costly undertaking, and so Verizon and Ericsson engineers have found an alternative way of using millimeter wave spectrum for backhaul, which can be used as an interim solution, and accelerate deployment of 5G networks, especially into more remote areas.

“Ericsson’s microwave and fiber mobile transport solutions are an important enabler for 5G services,” said Ulf Forssen, head of standards & technology, development unit networks, at Ericsson. “This IAB proof of concept demonstrates a complementary solution, enabling faster deployment of the high-quality, high-performance 5G transport needed in a 5G world.”

Verizon's IAB technology works by using an airlink, point-to-point connection over mmWave spectrum, instead of a fiber-optic cable to send data throughout the network. And a portion of bandwidth is automatically allocated to the task of sending data from a customer's device to the cell tower, whilst another portion is then allocated to send that data from the 5G towers to the core of the network.

Once fiber is installed, the mmWave allocation being used for backhaul can then be redistributed, providing greater 5Gcapacity for customers.

Elsewhere, in June 2021, Nokia, Qualcomm Technologies and UScellular announced that they had set a new world record, achieving near gigabit 5G speed for distances of more than 10 km, with average downlink speeds of 1 Gbps, and uplink speeds reaching approximately 57Mbps. Additionally, 750 Mbps downlink speed was recorded at a distance of 11km. This trial will pave the way to bring extended range 5G service with massive capacity and low latency to even more regions across the US, including rural areas.

The milestone was achieved on UScellular’s live 5G mmWave commercial network in in Grand Island, Nebraska, using Nokia's 5G extended-range mmWave solution and a 5G CPE powered by the Qualcomm Snapdragon X55 5G Modem-RF System with the Qualcomm QTM527 mmWave antenna module. The companies jointly tested multiple locations with different scenarios, measuring distance, throughput and latency.

What's the status?

As mentioned above, operators in the US are already using mmWave frequencies to power their services. However it will take time for the full benefits to be realised because of a lack of released spectrum and a dearth of compatible devices.

Although bands have been assigned on a global basis by the ITU, the process of issuing licences for these airwaves is decided by individual governments and regulators. UK regulator Ofcom is still working on its strategy for 26GHz, for example.

There’s also the issue of standardisation. Current 5G networks are using an early standard of the technology called Release-15 (R15) which is built on top of existing 4G infrastructure.

This summer, Release-16 will be completed, allowing networks to maximise the capabilities of mmWave spectrum once it is made available and fulfil the full potential of 5G technology.

- Discover the best 5G networks in the UK and US

- Get your hands on the hottest 5G phones

- Millimeter wave: the secret sauce behind 5G

- The complete guide to 5G security

- We reveal the latest 5G use cases

- Discover the truth behind 5G dangers

- 5G towers: everything you need to know

Steve McCaskill is a former editor of Silicon UK, and is an experienced journalist. Over the last eight years Steve has written about technology, in particular, telecoms, mobile, sports tech, video games and media.