The road ahead for 5G autonomous vehicles

With billions of connected vehicles on the roads by 2040, 5G could make the connected car a reality. Ross Hockey, VP of global alliances at Infovista, looks at the key challenges and opportunities.

Get up to speed with 5G, and discover the latest deals, news, and insight!

You are now subscribed

Your newsletter sign-up was successful

By 2040, there will be over 2 billion vehicles in use and connected cars will form the majority. At this point two decades out, most new sales at least in the mid-range price point, are likely be autonomous vehicles (AV) and the potential use case for connectivity in vehicles will emulate that of living room entertainment or even the traditional desk at work.

Although AV is a major future driver for the automotive industry, connectivity has been a growing trend for many years as widely deployed 4G networks deliver a pathway for highspeed car connectivity across audio, compressed video and two-way communication for BYOD and on-board apps. For instance in Europe, new car models approved for manufacture after 31 March 2018 must have the 112-based eCall system installed which uses a cellular modem within each vehicle. Although 4G is ideal for streaming low bandwidth content, the cellular connectivity that will be fitted into all new cars is likely to be 5G ready – allowing a software / SIM upgrade to take advantage of new higher bandwidth and lower latency networks as they arrive to the market.

"The scale of the opportunity is vast. For example, less than 10% of the 1.6 billion vehicles on the road currently support connected features."

Ross Hockey.

The scale of the opportunity is vast. For example, less than 10% of the 1.6 billion vehicles on the road currently support connected features. This gap offers not just potential for car manufacturers, but also third-party service providers keen on reaching this ‘in-transit’ audience. As connected applications become more useful, they also tend to become more mission critical – increasing the consequences from poor connectivity which can result in customer dissatisfaction, business impact and safety consequences.

Connected applications

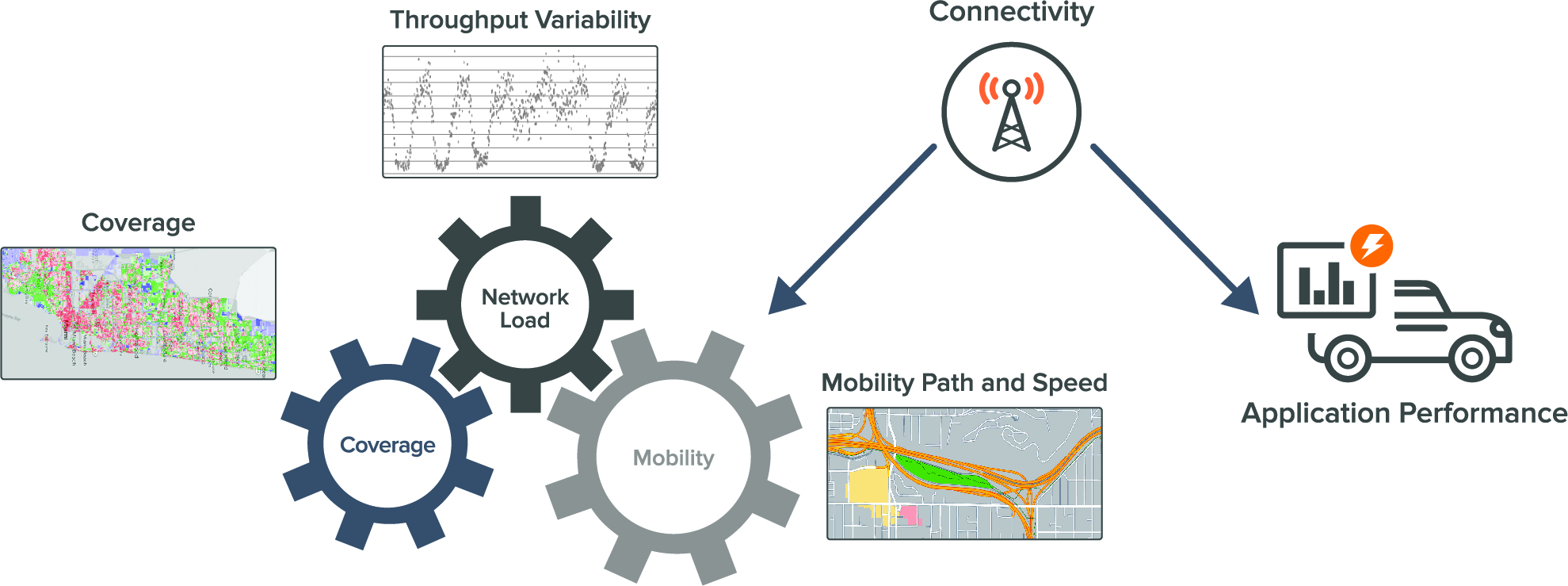

The goal for connected car applications is to perform satisfactorily wherever and whenever they are needed. However, cellular connectivity is variable and broadly speaking, there are three key factors that need to be considered when it comes to designing and operating connected mobile applications. The first is understanding each application connectivity needs as some will favour certain connectivity criteria such as latency over raw bandwidth. Next, understanding network coverage and finally performance which applies to both the network capacity versus load.

The connected car and mobile application design challenge is understanding how the interplay between these complex factors will vary connectivity - and the resulting impact on application performance.

Network vs Application Perspective

Network operators typically focus on delivering network coverage and Quality of Service (QoS) – and they do this by monitoring and optimising Key Performance Indicators (KPI) such as data throughput and cell loading. Since these KPI’s are measured at the network “side” of the wireless link, the reporting is typically focused on average rather than individual performance and user experience.

This can be quite different from the application perspective. Consider an average performance of 5 for example – that could be six users with scores of 5,5,5,5,5,5 or six users with scores 9,1,9,1,9,1 – three happy and three unhappy illustrating how reporting averages can miss identifying individual user or application problems. This averaging out creates a critical need to measure and monitor connectivity performance at the application end of the wireless link.

Get up to speed with 5G, and discover the latest deals, news, and insight!

"A number of automotive manufacturers and mobile application designers are using connectivity testing and monitoring solutions that offer this visibility at a granular level."

Ross Hockey.

As a result, a number of automotive manufacturers and mobile application designers are using connectivity testing and monitoring solutions that offer this visibility at a granular level, along with deep data analytics and predictive connectivity to make appropriate design and operational choices. In practical terms, this means deploying similar ‘drive test’ software and hardware that mobile operators use to check networks, but with the data used to help design apps before even the first line of code is written. These metrics provide a user-side perspective to help understand how the application will perform during intended mobility since knowing after the fact might be too late.

Predictive understanding

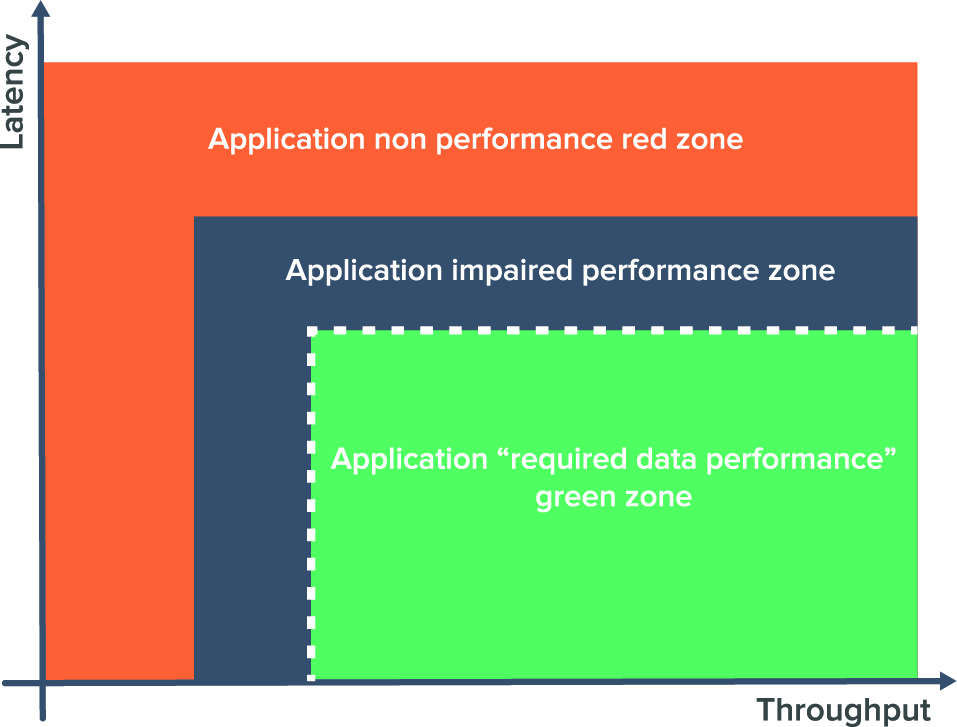

These data sets also help build predictive algorithms that can adjust application functions based on what the likely connectivity footprint will look like during a journey. Consider designing an application that is intended to be used by a fleet of vehicles, or connected cars operating in a typical city. Different applications have varying throughput, latency and continuity connectivity requirements for effective operation (indicated in the green zone in figure 2). Predictive connectivity data can be leveraged to show if, where and how often application performance may be impacted, across an area of mobile operation and with what consequences.

If the predicted outcomes are unsatisfactory, then there are three options; improve the network to address poor connectivity areas, change the application connectivity reliance, or “train” the application to cope with the variability it will encounter. This connected mobility perspective can be leveraged to aid application design, simulation and testing and is supplemented by ongoing monitoring during operation to provide a feedback loop able to catch degradation over time aiding in continuous improvement.

Predictive connectivity data - correlated with application performance KPI’s and other impacting factors like time of day, weather conditions and mobility – can be used to enable applications to “predict connectivity in advance” enabling them to take proactive steps to mitigate the impact of gaps or areas of poor connectivity.

Humans already do this with our cell phones - knowing that spot on a commute where calls always drop – and proactively mitigating by either finishing the call beforehand or saying, “Hey the call is about to drop I’ll call you back in a minute.” Predictive connectivity data can also be used to avoid poor connectivity altogether by choosing a route with good coverage – like choosing a route to avoid red traffic congestion on the map for a drive home.

Connectivity monitoring in action

Many of the “smart” 5G use cases involving mobile application connectivity will be ground-breaking and as such will likely have teething issues that can be difficult to pin down. The connectivity delivery chain is complex involving client, device, modems, connection, location, cloud, data centre and hosted services. This complexity can make fault diagnosis and remediation challenging. Monitoring connectivity and application performance provides visibility into customer experience and application performance over time – and gives early warning of satisfaction and safety issues. This problem identification visibility, combined with the collected data, helps identify whether the cause is poor connectivity, application issues or modem (telecommunications control unit) issues. The near real-time connectivity visibility provided by monitoring enables faster responses to customer experience impacting issues, reducing time to repair and warranty costs.

"A major European car manufacturer is already using onboard connectivity telemetry to assist its dealers that carry out repairs."

Ross Hockey.

A major European car manufacturer is already using onboard connectivity telemetry to assist its dealers that carry out repairs. In this scenario, a connected car owner reports a fault with an onboard application such as In-car WiFi hotspot. The root cause may reside within a faulty component such as the access point, or the on-board modem (TCU) or alternatively it may be a network issue. Previously, the manufacturer allowed access to the onboard connectivity monitoring tools, and the dealership would typically replace the entire TCU to solve this class of problem – only to have the unhappy customer return reporting it not fixed. In some cases, the problem ended up being network related. Connectivity monitoring overcomes this expensive and time-consuming trial and error – with the ability to examine the connectivity profile of the vehicle, not just when its stationary within the service garage, but across its journeys to identify where the fault is occurring.

Cloud future

Although these telemetry units and software elements are typically only available in mid and high-end vehicles, many of the connectivity testing tools are being deployed via the cloud to extend their utility. This allows lower cost options for entry level vehicles where each car can send back basic diagnostics data to the cloud for deeper analysis. This allows for not just fault diagnostics, but to also feed into potential collaborative projects between telecoms operators and car manufacturers to – offer a symbiotic and beneficial partnership – helping operators to spot and solve connectivity issues before they impact the growing community of connected car users.

Ross Hockey is VP of global alliances at Infovista. Infovista specializes in data and analytics, and provides complete visibility and unprecedented control of your network and business-critical applications, leading to improved user experiences and maximum value. Infovista offers a comprehensive line of solutions from radio network to enterprise to device throughout the lifecycle of your network. Network operators worldwide depend on Infovista to deliver on the potential of their networks and applications.