How CSPs can survive in a dynamic 5G world

In this post, Scott Sumner, director of commercial insight at EXFO, discusses why 5G network automation is so important in reducing churn and keeping customers happy.

Get up to speed with 5G, and discover the latest deals, news, and insight!

You are now subscribed

Your newsletter sign-up was successful

Will network operations centers (NOCs) someday take a secondary role to service operations centers (SOCs)? That certainly is the ambition of many communications service providers (CSPs), as they look to focus on the customer experience first. But it’s proving much more difficult than first anticipated.

There are two big reasons why: complexity and automation.

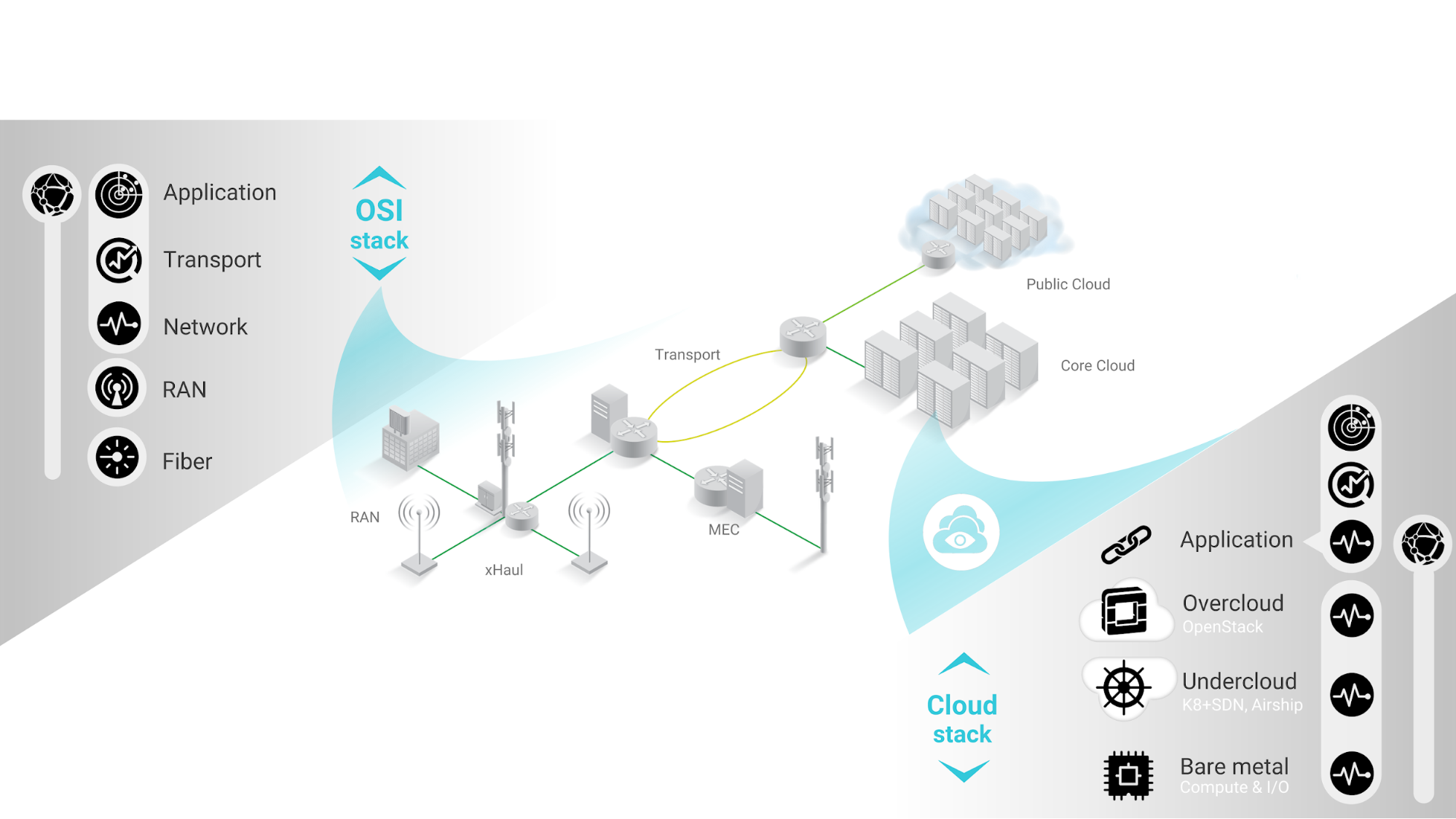

Networks are becoming more complex to manage. There are more types of traffic traversing the network, more types of devices accessing the network, and more types of services being offered. All these “mores” are happening simultaneously, and come during the transformation from traditional physical networks to virtualized network functions and dynamic, on-demand services.

The dynamic traffic patterns seen during the COVID-19 pandemic foreshadow how 5G will intensify the effects of complexity. In a dynamic 5G world, as during a pandemic, conditions are likely to rapidly change in unexpected ways. This makes it even harder to stay in control and keep customers happy.

It can be done, however, if CSPs have ways to head off service degradations and network outages through predictive, proactive measures.

Automation is the most promising path forward.

Automation appeal

The cloudification of telco networks adds another full stack to manage, and another source of impairments introduced by virtualized infrastructure. Automation is key to quickly identifying root cause across this increasingly complex network.

Get up to speed with 5G, and discover the latest deals, news, and insight!

It would be reasonable to assume CSPs are interested in automation first and foremost for its potential to cut OpEx. But, when surveyed, they told a different story.

- The top reason CSPs are adopting network and service assurance automation cited – by 90% – is to enable digital transformation in operations.

- In second place, 77% of CSPs say their main reason for automation is to improve their Net Promotor Score (NPS) and create a better user experience for their customers.

- In third place, an aspect of OpEx finally starts to make an appearance, with 70% of CSPs saying they plan to use automation mainly to eliminate degradations.

- Reducing OpEx finally shows up on its own in fourth place, cited by 62% of CSPs as their main driver for automation.

Taken together, these responses indicate that, on the face of it, user experience is more important to CSPs than cost.

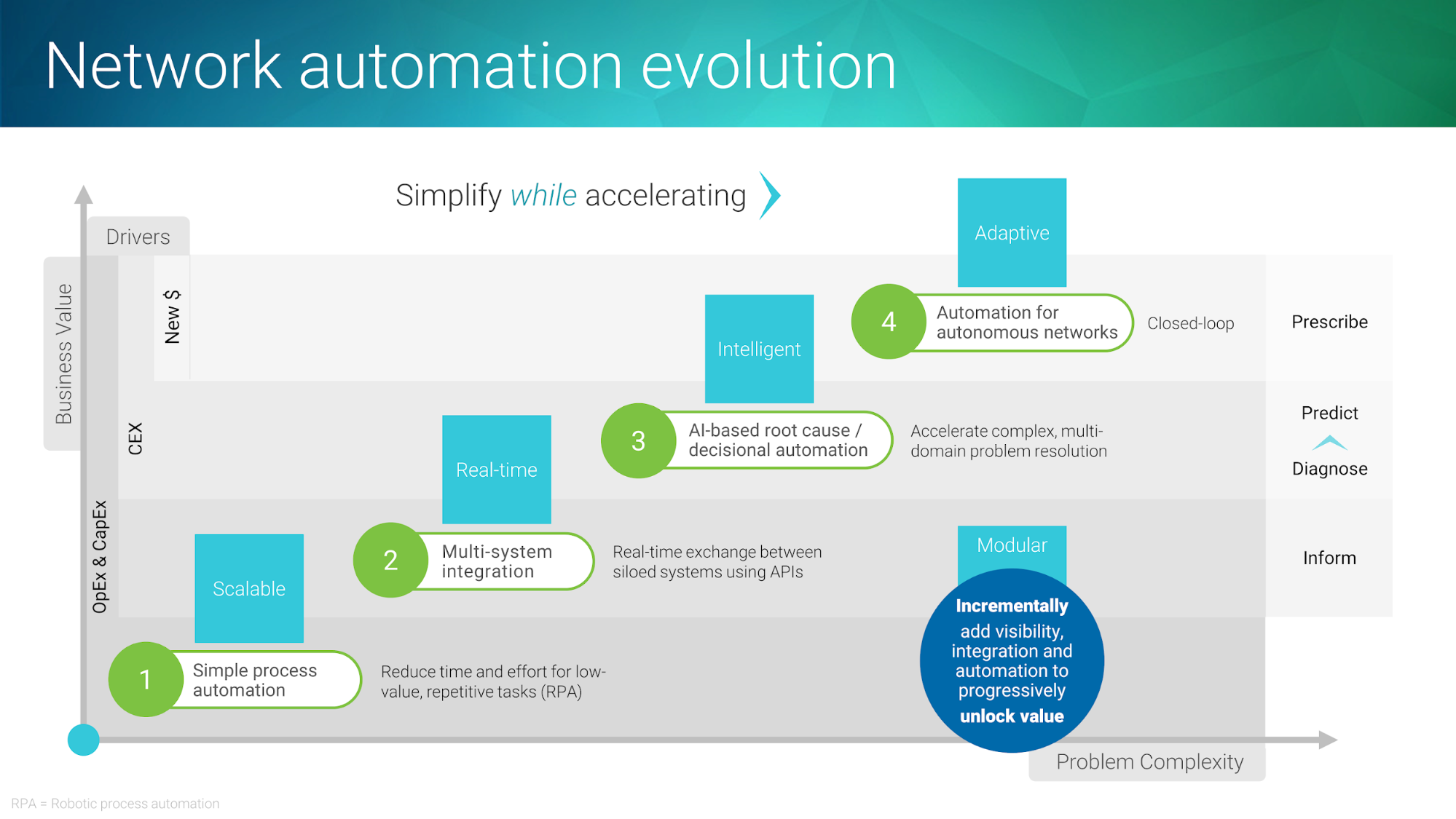

Network automation evolution

This makes sense: it’s expensive to replace customers who leave, and CSPs already experience about 20% churn every year. Converting unhappy customers to satisfied ones through a better service experience will significantly reduce churn rates and increase total lifetime value. This also has the potential to create more brand loyalists, who attract new revenue through referrals (stimulated by rising Net Promoter Scores).

Loyal subscribers add 5% to the bottom line in incremental profit. They stay with the CSP longer, cutting down on the need to offer incentive discounts or pay penalty credits. Because the average CSP makes about an 8% profit each year, boosting profits by 5% translates to 40% gain in the amount of cash on hand to build 5G networks and invest in the future.

The steps need to improve customer happiness must begin with an awareness of their experiences. As much as 98% of poor user experience is caused by degradations, not outages. These manifest as short-lived issues that momentarily stop users from getting things done, and result in disloyal customers very likely to churn. Often, these degradations come and go so quickly that existing systems don’t pick them up, so the CSP is unaware there is a problem.

Automation and artificial intelligence (AI) show great promise for helping CSPs stay in control, eliminate degradations, and improve user experience. But making it a fundamental aspect of CSP operations is much, much easier said than done.

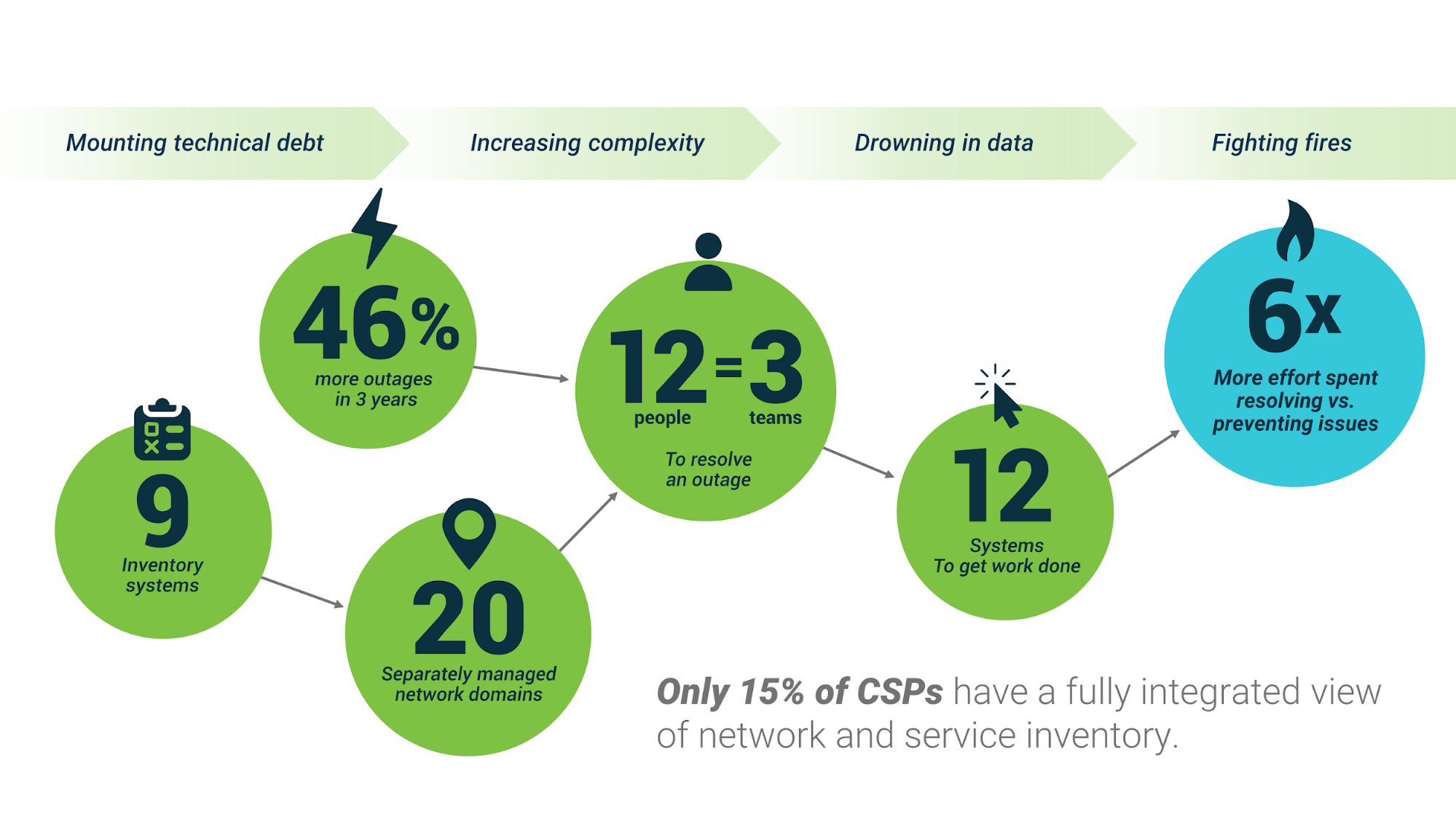

What’s holding back automation?

Here are some clues to the puzzle.

Real-time monitoring and analytics integrated into automation is crucial; 91% of CSPs say they need this. Without it, how will they know if automation is working? But predictive analytics is pretty much impossible without real-time data feeds; 5-minute or 15-minute averages won’t work because they’re too infrequent and don’t reveal the short-lived issues noted previously.

Real-time data capture is also crucial, but is largely missing: 90% of CSPs say they need it, but 65% don’t have it. This is an end-to-end problem: data must come into the instrumentation layer quickly, and be sped through to analytics immediately.

MNOs are now demanding open APIs to access and automate their service assurance systems. Streaming data buses, like Kafka, allow the provider’s systems to ingest and analyze data from multiple sources to gain a complete picture of their networks and services in real-time.

Data quality is also an issue: 65% of CSPs say problems in this area prevent automation. It’s an issue exacerbated by the siloed nature of existing service assurance. On average, an operator uses six different systems to determine the root cause of issues. When these systems can’t talk to each other, or have conflicting information, automation becomes impossible. There is no path forward without establishing a single source of truth.

The inevitable conclusion from all this: when they lack real-time automation all the way through to the user experience level, CSPs are held back by slow and cumbersome root cause analysis and problem resolution processes.

Data sources in this article include surveys from IHS Market, TM Forum, Coleman Parkes Research and Heavy Reading from 2019, and global churn data from Omdia, 2020.

Scott Sumner is the Director of Commercial Insight at EXFO, covering strategy, sales enablement and analytics. Scott has extensive experience in wireless and mobile telecom, AI and analytics, and service assurance. He has over 20 years of industry experience, including in roles as Director of Strategy and Communications at Nuvoola, VP of Marketing and Analytics at Accedian, GM of Performant Networks, Director of Program Management at MPB Communications, VP of Marketing at Minacom (Tektronix), as well as project and engineering management roles at PerkinElmer (EG&G). Scott has led numerous acquisitions and industry partnerships, and has authored numerous patents and conference papers.

Scott has Masters and Bachelor degrees in Engineering (M.Eng, B.Eng) from McGill University in Montreal, Canada, and completed professional business management training at the John Molson School of Business, the Alliance Institute, and the Project Management Institute.