Nokia and ABI Research identify key trends in Industry 4.0 investment

More than 600 manufacturing decision-makers have been surveyed to assess investment strategies related to 4G, 5G and Industry 4.0.

Get up to speed with 5G, and discover the latest deals, news, and insight!

You are now subscribed

Your newsletter sign-up was successful

Nokia has partnered with ABI Research, an independent research firm, to ask more than 600 manufacturing decision-makers about their investment strategies in relation to 4G/LTE, 5G and Industry 4.0.

The report, titled ‘Enterprise digital transformation through Industry 4.0’, found that 74% of respondents are looking to upgrade their communications and control networks by the end of 2022, with more than 90% investigating the use of either 4G and/or 5G in their operations. And just over half of respondents (52%) believe that the latest generation of 4G/LTE and 5G will be necessary to meet their transformational goals.

“We have reached an inflection point in Industry 4.0 transformation as the fast, secure, low latency connectivity underpinning its implementation now becomes available,” said Manish Gulyani, Vice President Marketing, Nokia Enterprise. “This research indicates the strong marketplace appetite for industrial-grade wireless networking to capture the transformational benefits of digitalization and automation. We believe that demand, combined with easy-to-deploy private wireless solutions, will drive adoption.”

The case for investing in Industry 4.0

“Importantly, research findings indicate a preference for deploying private fully-owned and operated wireless networks, with manufacturers favoring in-house management."

Ryan Martin, ABI Research.

The report surveyed 602 respondents, in various decision-making roles across automotive (201), consumer goods (201), and machinery (200) markets. And the geographic spread of respondents was U.S. (161), Germany (100), Japan (100), China (40), India (40), Australia (40), U.K. (41), Canada (40), and France (40).

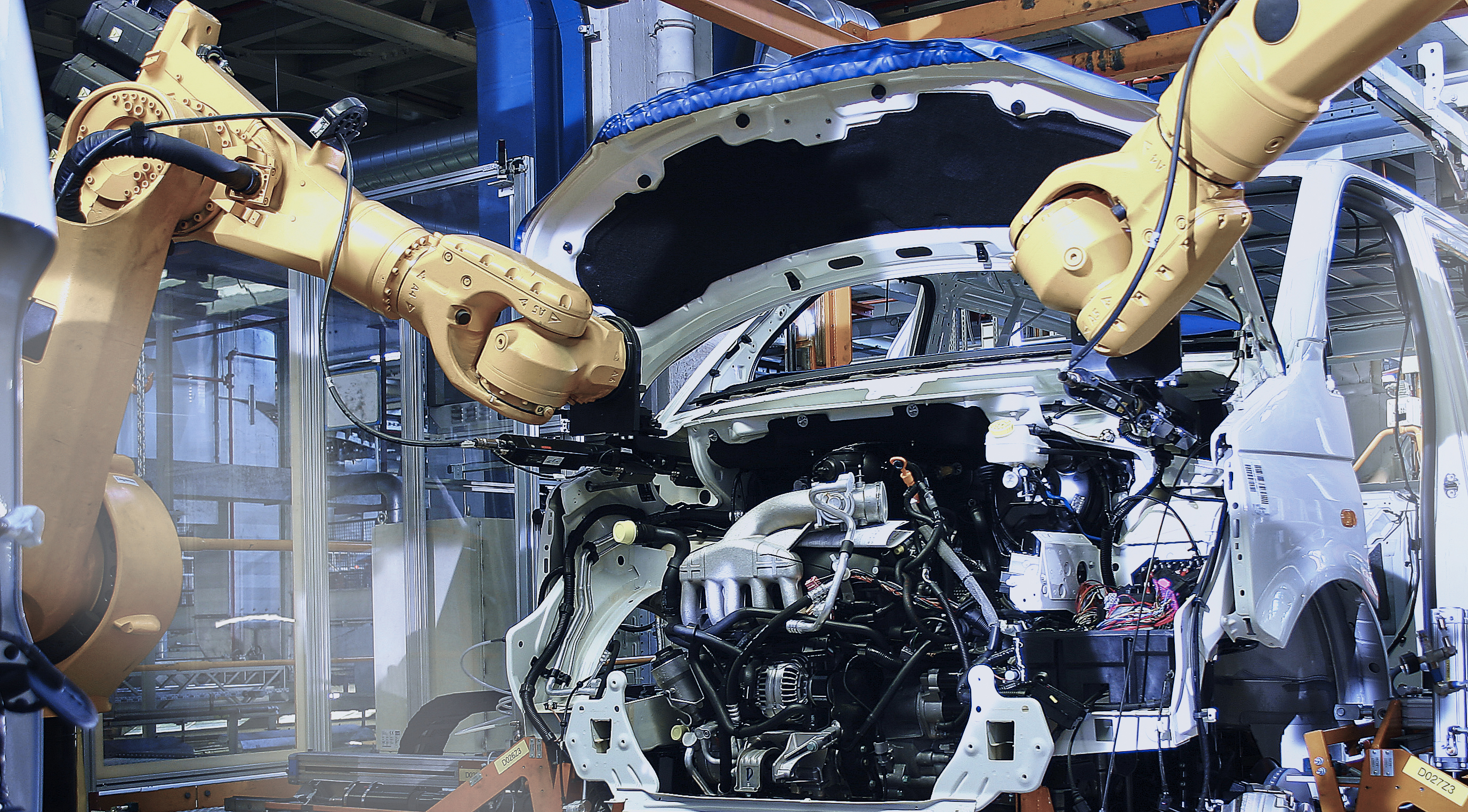

The research also identified key business use cases that would drive investment in 4G or 5G. Respondents reflected the need to digitalize and improve existing infrastructure (63%), automation with robotics (51%) and achieve new levels of employee productivity (42%). The report also found that a large proportion (84%) are considering the deployment of their own local private wireless network in their manufacturing operations, with IIoT initiatives being a primary focus (41%).

“Importantly, research findings indicate a preference for deploying private fully-owned and operated wireless networks, with manufacturers favoring in-house management to allay security concerns,” said Ryan Martin, Principal Analyst, ABI Research. “It’s evident that respondents are not entirely committed to Wi-Fi/WLAN and will consider latest generations of wireless technologies. As a result, 2020 is a critical year for networking suppliers to educate the market regarding the merits of 4G/LTE and 5G.”

Based on this survey ABI Research concluded that there is a pan-industry need to quantify the potential ROI of investing in private wireless, as well as calculating the cost of inaction.

Get up to speed with 5G, and discover the latest deals, news, and insight!

“Vendors need to make the case for investing in Industry 4.0 today to gain a clear competitive advantage over those who choose to wait,” concluded Martin.

The survey was completed at the end of 2019, and thus before the onset of the Covid-19 pandemic.

- Discover the best 5G networks in the UK and US

- Get your hands on the hottest 5G phones

- Millimeter wave: the secret sauce behind 5G

- The complete guide to 5G security

- We reveal the latest 5G use cases

- Discover the truth behind 5G dangers

- 5G towers: everything you need to know

Dan is a British journalist with 20 years of experience in the design and tech sectors, producing content for the likes of Microsoft, Adobe, Dell and The Sunday Times. In 2012 he helped launch the world's number one design blog, Creative Bloq. Dan is now editor-in-chief at 5Gradar, where he oversees news, insight and reviews, providing an invaluable resource for anyone looking to stay up-to-date with the key issues facing 5G.