Private 5G network market worth $920m in 2020

A new report from Grand View Research examines the global market for private 5G networks in 2020 and beyond.

Get up to speed with 5G, and discover the latest deals, news, and insight!

You are now subscribed

Your newsletter sign-up was successful

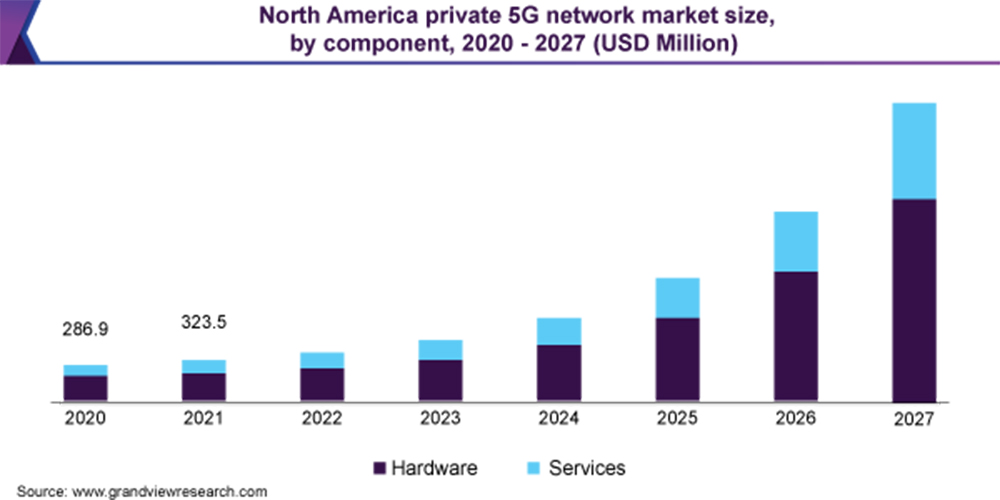

According to a new report from the California-based company Grand View Research, The global market size for private 5G networks will reach $920 million in 2020, and is estimated to register a compound annual growth rate (CAGR) of 37.8% from 2020 to 2027.

While consumer-facing mobile network operators (MNOs) talk predominantly about the speed of downloads, for manufacturing, the focus turns to ultra-reliable low-latency, density and ubiquitous connectivity. And it’s these lesser-known features, beyond the breakneck 5G speed, that are encouraging industry to construct private 5G network infrastructure in industrial plants and warehouses.

The report from Grand View Research claims that by 2020, the hardware segment is estimated to account for a market share of more than 70.0%, and said that it is due to the “growing deployment of core network and backhaul and transport equipment across the globe”.

Private 5G network segments

The hardware segment mainly encompasses three component categories, including radio access network (RAN), core network, and backhaul and transports. Whilst the ‘services’ segment includes three key services, such as installation and integration, data services, and support and maintenance.

A recent report from Nokia and ABI Research supports the high expectations for private 5G networks, highlighting the importance of IIoT (industrial internet of things), and finding that 63% of respondents said they needed to improve existing infrastructure, with 51% saying that they would use automation with robotics to achieve new levels of employee productivity.

Spectrum is key

According to the report, mmWave frequencies will be a key ingredient in the successful implementation of private 5G networks. And whilst sub-6 GHz 5G poses serious challenges for MNOs looking to increase the range of millimeter wave services, this is less of an issue for industrial use, where connectivity may only be required across a much smaller area.

And countries around the world are working hard to free up this vital spectrum, with the Federal Communication Commission (FCC) releasing several mmWave frequencies, including 24.25–24.45 GHz, 47.2-48.2 GHz, 24.75–25.25 GHz, and 38.6-40 GHz, among others (other countries, such as Russia, Japan, South Korea, and Italy, among others, have released mmWave frequencies for enhanced data services).

Get up to speed with 5G, and discover the latest deals, news, and insight!

And the report claims that this focus on mmWave frequencies by key federal governments – across many countries – is expected to augment the mmWave segment growth in the private 5G network market over the next seven years.

- Discover the best 5G networks in the UK and US

- Get your hands on the hottest 5G phones

- Millimeter wave: the secret sauce behind 5G

- The complete guide to 5G security

- We reveal the latest 5G use cases

- Discover the truth behind 5G dangers

- 5G towers: everything you need to know

Dan is a British journalist with 20 years of experience in the design and tech sectors, producing content for the likes of Microsoft, Adobe, Dell and The Sunday Times. In 2012 he helped launch the world's number one design blog, Creative Bloq. Dan is now editor-in-chief at 5Gradar, where he oversees news, insight and reviews, providing an invaluable resource for anyone looking to stay up-to-date with the key issues facing 5G.