5G adoption is flying, says Ericsson

In a review of the current state of 5G, Ericsson has highlighted how the lessons of 4G roll-out have been adopted by communication service providers.

Get up to speed with 5G, and discover the latest deals, news, and insight!

You are now subscribed

Your newsletter sign-up was successful

Despite the temptation to knock the roll-out of 5G networks in the media, and draw attention to its lack of availability, the reality is that the uptake of 5G is at least twice as quick as it was for 4G, with 3G uptake being even slower.

In a new blog post, the first in Ericsson’s new ‘5G Practioner’s Guide’, the company outlines that in the 4G era, there was a choice between being a first mover and being a follower, and that first-mover advantage played a massive part in whether a communication service provider (CSP) was successful or not.

“For 5G, the bias has shifted to a market where first-mover advantages rule,” the post explains. “Businesses see first-mover advantages as the most important strategic priority for 5G, with narrow windows to target for leadership.”

Faster 5G take up

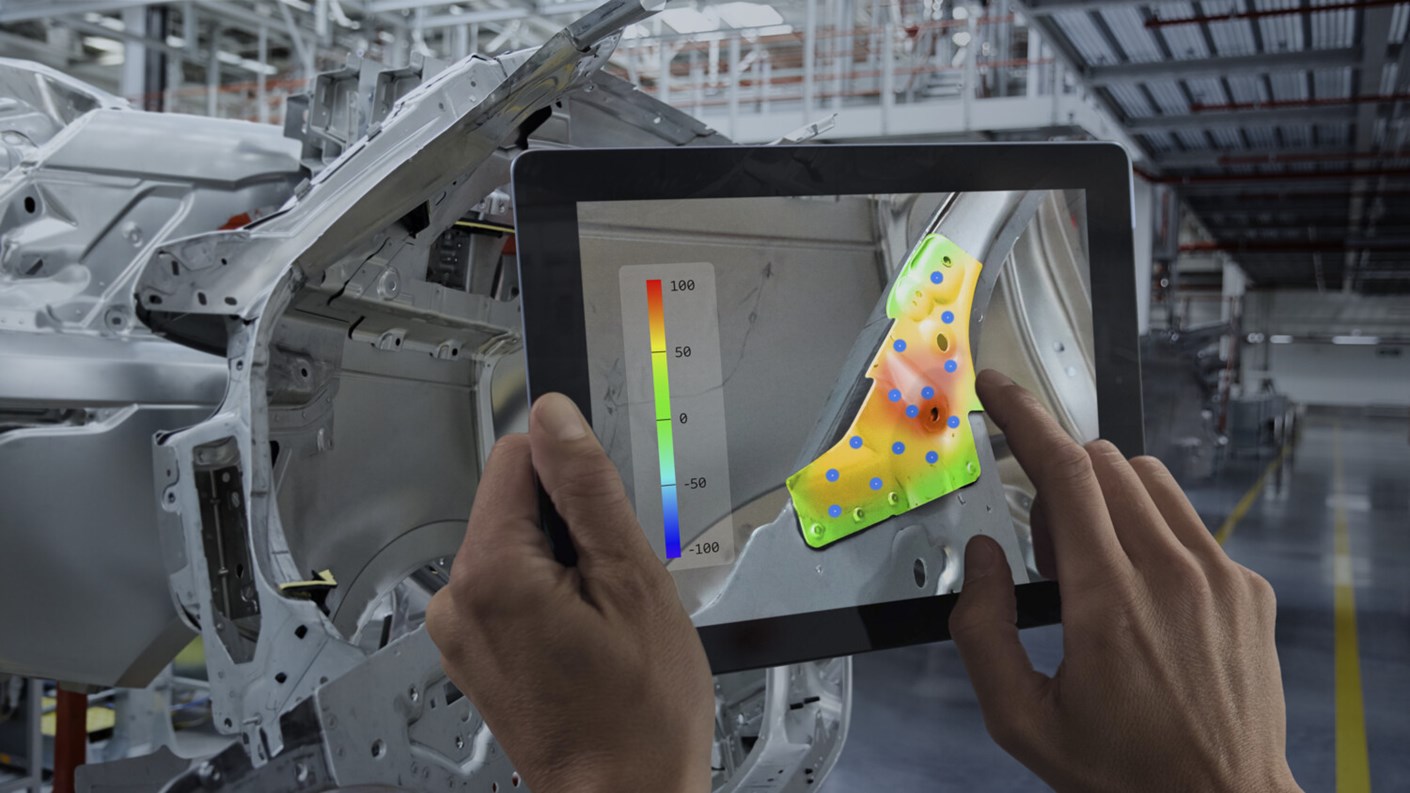

"“We can also expect an increased emphasis on workforce mobility compared to what we did not see three months ago, beyond home and offices.”

Ericsson.

It may not come as a surprise that a company like Ericsson, with its focus on developing 5G infrastructure, is highlighting the importance of first-mover advantage, but it is backed up by statistics.

When 4G launched, just four networks launched dedicated services in the first year, whilst in 2019 – 5G’s first year in the wild – there were 59 5G network launches. Communication service providers (CSPs) have clearly learned the lessons from the slow 4G roll-out, though.

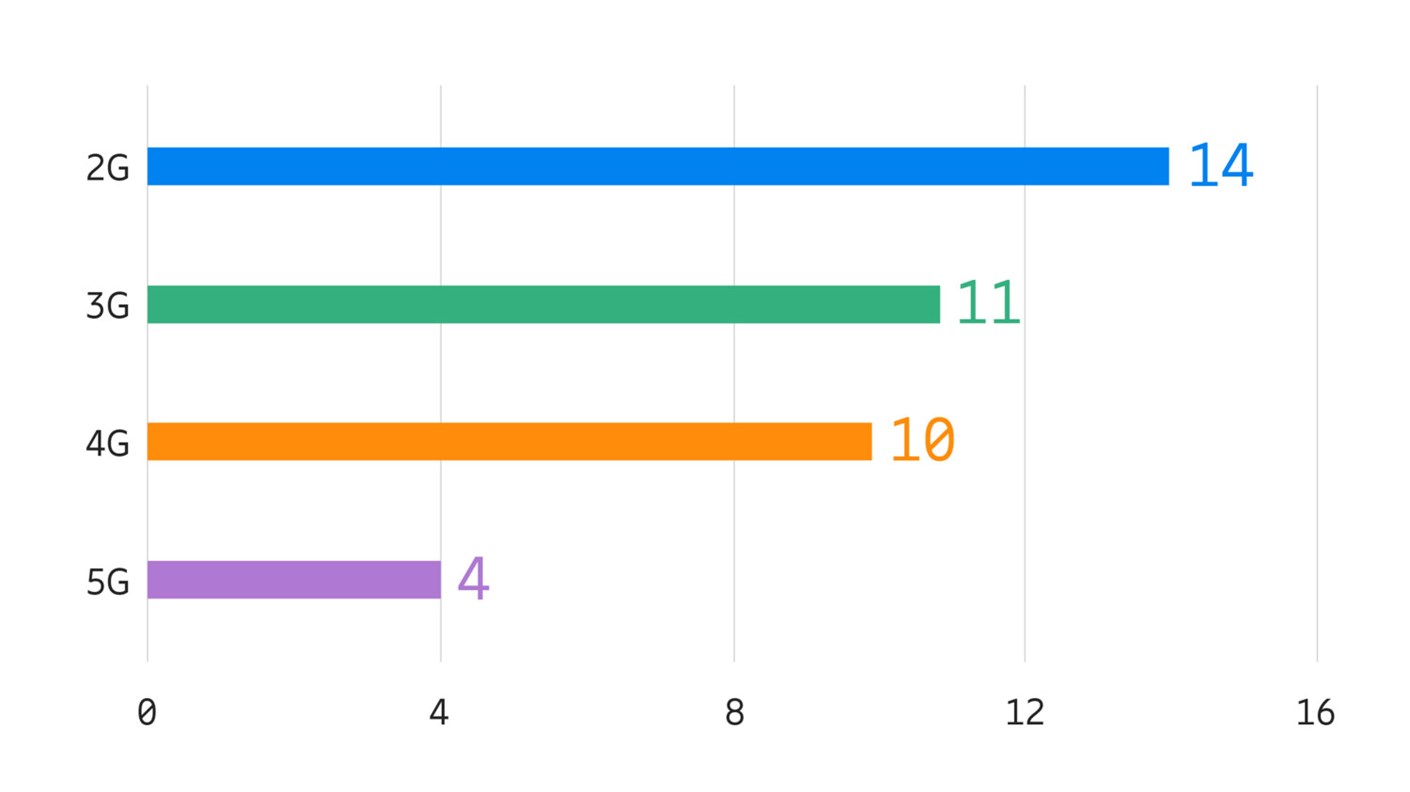

And according to Ericsson, 17.7 million subscribers adopted 5G services worldwide in the first year. For previous mobile generations, reaching the same volumes took 10 quarters for 4G, 11 quarters for 3G, and 14 quarters for 2G. And in a previous survey, Ericsson discovered that front-runner groups (as it calls them) were far more likely to do well.

“Ericsson noticed a small group of 4G service providers standing out for their remarkable performance,” its latest post says. “This front-runner group captured all mobile service provider growth in the previous decade. The CAGR for the forty-nine 4G front-runners worldwide was 8.5 percent up until 2018, at the same time as the remaining 238 services providers declined by 1.95 percent. Winners took it all for 4G.”

Get up to speed with 5G, and discover the latest deals, news, and insight!

According to Ericsson, it may be too late for networks to make an impact with new 5G networks, as 2019 was the year for first-mover advantage, but in other areas, such as business-focussed 5G uses cases, there is still an opportunity.

“The first 5G use cases for businesses can leverage a strong adoption in the smartphone segment,” the Ericsson posts says. “We can also expect an increased emphasis on workforce mobility compared to what we did not see three months ago, beyond home and offices.”

- Discover the best 5G networks in the UK and US

- Get your hands on the hottest 5G phones

- Millimeter wave: the secret sauce behind 5G

- The complete guide to 5G security

- We reveal the latest 5G use cases

- Discover the truth behind 5G dangers

- 5G towers: everything you need to know

Dan is a British journalist with 20 years of experience in the design and tech sectors, producing content for the likes of Microsoft, Adobe, Dell and The Sunday Times. In 2012 he helped launch the world's number one design blog, Creative Bloq. Dan is now editor-in-chief at 5Gradar, where he oversees news, insight and reviews, providing an invaluable resource for anyone looking to stay up-to-date with the key issues facing 5G.