5G-powered time-sensitive networking market predicted to top $1bn by 2026

A new report from Global Market Insights has revealed that, according to insight from 20 leading companies in the sector, the market size for time-sensitive networking will surpass $1bn by 2026.

Get up to speed with 5G, and discover the latest deals, news, and insight!

You are now subscribed

Your newsletter sign-up was successful

Time Sensitive Networking (TSN) is a family of the IEEE 802.1 standard that enables time synchronization and data delivery within an IoT setting, and it includes strict latency bounds, which are vital if technology is going to work in an industrial setting, with multiple connected devices.

To date, TSN networks have been implemented using Ethernet technology, but with the increasing rollout of 5G technology, wireless TSN is becoming a reality for the first time, as it provides the low latencies necessary for the industrial internet of things (IIoT).

And according to a new ‘Time-Sensitive Networking Market’ report from Global Market Insights, the TSN market surpassed $200m in 2019 and is expected to have a compound annual growth rate (CAGR) of more than 30% between 2020 and 2026, taking the market size to more than $1bn by the end of that period.

“North America's time-sensitive networking market dominated the global revenue share with over 50% in 2019 impelled by advent of Industry 4.0 across the region."

TSN report.

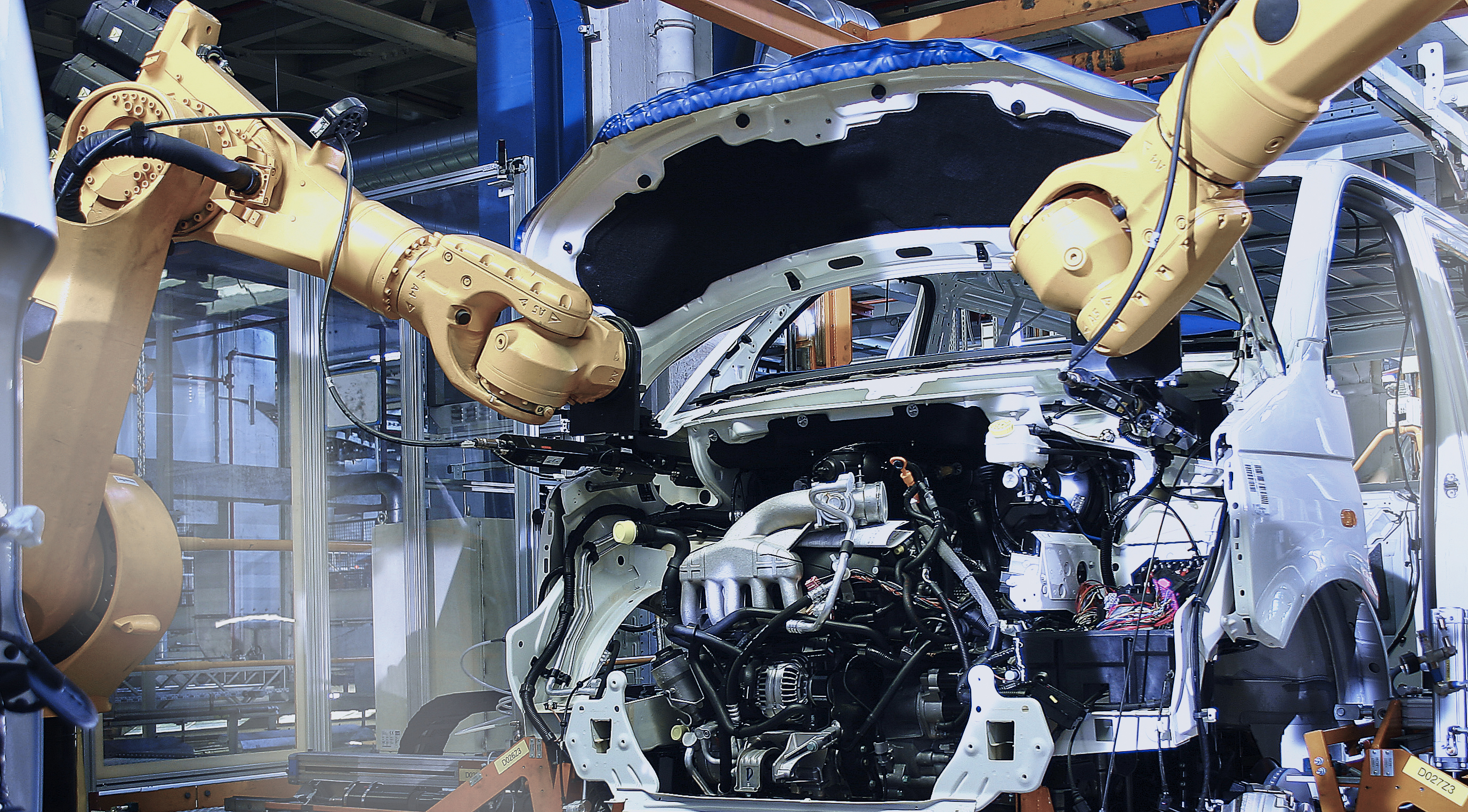

“North America's time-sensitive networking market dominated the global revenue share with over 50% in 2019 impelled by advent of Industry 4.0 across the region,” the report introduction explained. “Supportive government initiatives for increasing adoption and industrial automation among manufacturing and automotive industries are estimated to have significant impact on the business. The presence of a large number of industrial automation players in the region will also foster market revenue.”

5G and time-sensitive networking

With the potential to enable wireless connectivity for a variety of industrial applications, 5G use cases using TSN will be a boon for manufacturers of end-devices and systems across IIoT, enabling them to easily reconfigure industrial automation, control systems, factory automation, and other elements of Industry 4.0. And we can expect wireless TSN and 5G to completely transform the future of wireless networks with high reliability, resiliency, and security.

“Industry players are emphasizing on developing TSN components for next generation 5G network,” the report said. “For instance, in November 2019, Infinera introduced its X-haul-optimized TSN optical switch for 5G network and deep fiber applications. This new solution helps network operators to deploy 5G and deep fiber applications cost-effectively.”

The increasing demand for real-time networking across different industry sectors, such as manufacturing, automotive, transportation, energy & utility, aerospace, and oil & gas, is also helping the market grow.

Get up to speed with 5G, and discover the latest deals, news, and insight!

“The rising adoption of autonomous vehicles is enabling leading market players to develop innovative TSN components for automotive applications,” according to the report. “For instance, in January 2020, NXP Semiconductors introduced a safe automotive ethernet switch, e NXP SJA1110 for TSN. This new product launch helped the company to help automotive manufacturers to deliver high-speed networks required for connected vehicles. The NXP SJA1110 helps in providing a high level of performance, security, and safety for automotive applications.”

Companies covered in the market report include Analog Devices, Inc., Belden Inc., Broadcom Limited, Cisco Systems, Inc., Infinera Corporation, Intel Corporation, Marvell Technology Group Ltd., Microsemi Corporation, National Instruments Corporation, Nokia Corporation, NXP Semiconductors Inc., Renesas Electronics Corporation, Siemens AG, TTTech Computertechnik AG, and Xilinx, Inc.

- Why 5G small cells are vital for mmWave 5G

- Millimeter wave: the secret sauce behind 5G

- Get updates on the hottest 5G stocks

- We reveal the latest 5G use cases

- Discover the truth behind 5G dangers

- 5G towers: everything you need to know

Dan is a British journalist with 20 years of experience in the design and tech sectors, producing content for the likes of Microsoft, Adobe, Dell and The Sunday Times. In 2012 he helped launch the world's number one design blog, Creative Bloq. Dan is now editor-in-chief at 5Gradar, where he oversees news, insight and reviews, providing an invaluable resource for anyone looking to stay up-to-date with the key issues facing 5G.